APC308: Financial Management Assignment Help

Question

APC308: This is a Financial Accounting assignment for the University of Sunderland, London, which demands the student to choose two questions from the three questions provided in the task file and answer these appropriately. The student will need to demonstrate their understanding related to the important strategic decisions for a business and the role accounting and financial management play in making these decisions.

Solution

For this Bachelors in Accounting and Financial Management assignment, our experts offer top-quality help to our students. The accounting and finance seasoned professionals at OAS have written a comprehensive solution demonstrating a thorough understanding of the important analytical skills required to make business-related decisions. We have provided a snippet of the complete solutions below:

Question 1

A case study has been provided where the student is supposed to elaborate and analyze the cost of capital and capital structure, for which students need APC308 assignment help. It has been remarked that Athena PLC’s recently hired finance director is examining the organization’s capital structure. She is certain that the business isn’t funding itself in a way that lowers its capital costs. The funding for the business is given, based on which the following questions need to be answered by the student.

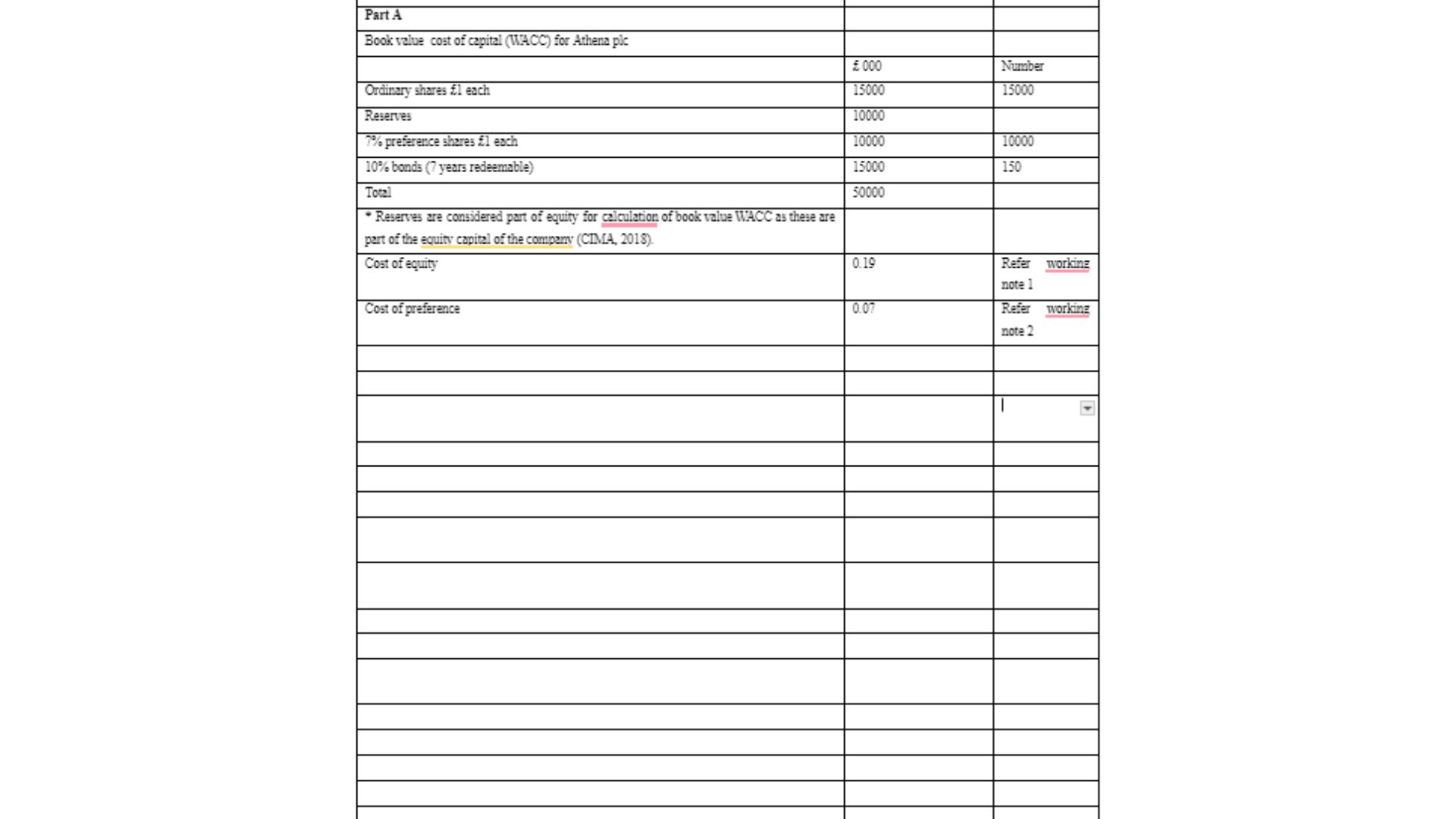

Part A

In this first part of this question, the student is supposed to determine Athena plc’s book value and market value cost of capital.

Want to get the best Financial Management Assignment help in London? You are at the right place! WhatsApp us at +447700174710 today!

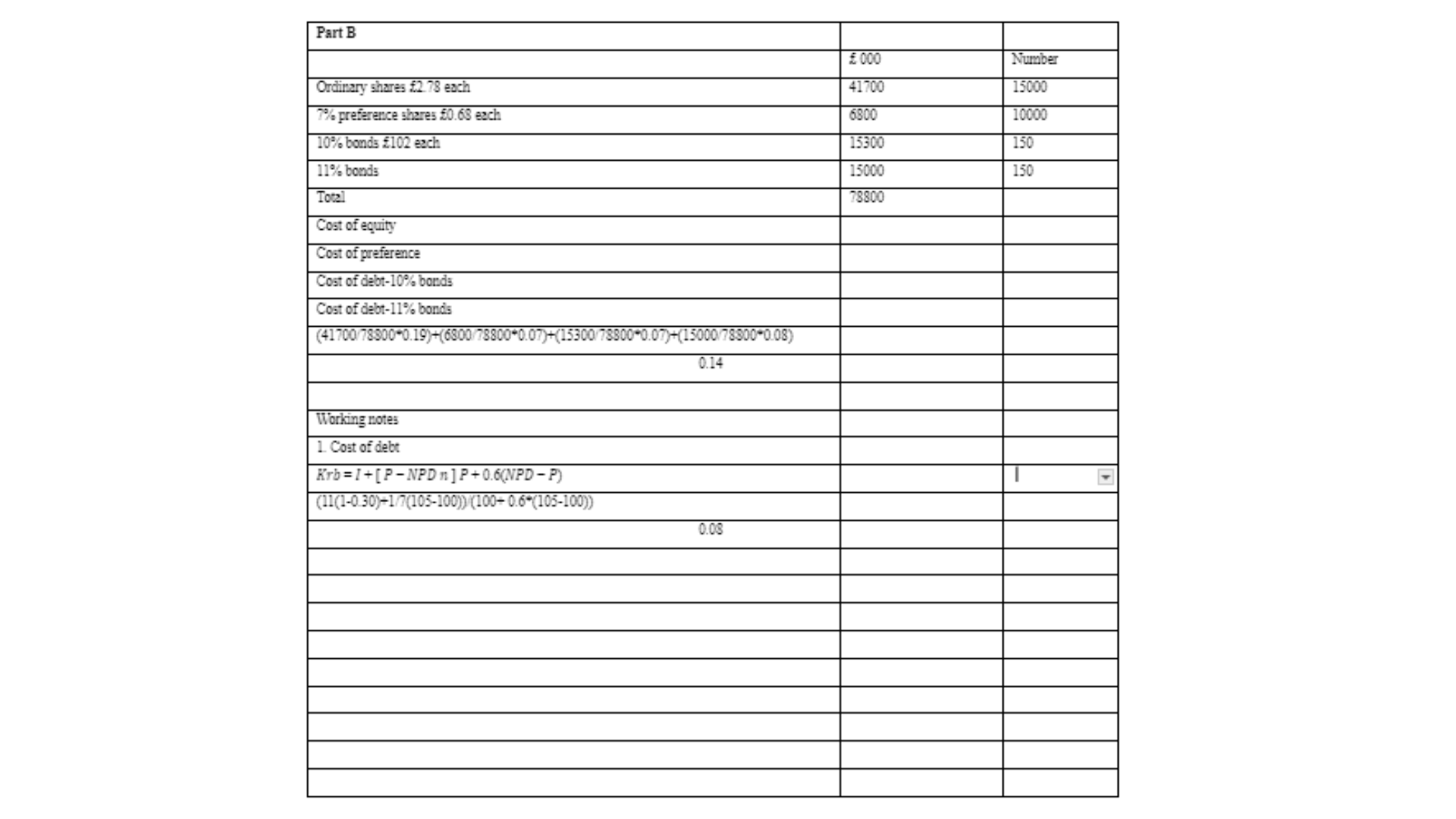

Part B

In providing Financial Management Assignment help for this part, our experts have calculated the company’s cost of capital based on the suggested modifications to Athena’s capital structure.

Get Accounting and Financial Management Assignment Help in UK from the best subject matter experts! Call us at +61 871501720.

Part C

For this section, our experts have pointed out and discussed potential errors in the finance director’s projections through careful analysis of the data given.

Possible imperfections that may transpire to the finance director’s estimates include the use of the dividend growth model using compounded returns. The CAPM model would have resulted in potentially different results (Johnson and Melicher, 2017). Also, the cost of debt as reflected in the company accounts may not be reflecting the appropriate interest rate (Madura, 2018). The market values of debt and equity are at the best an estimate and have not been subjected to sensitivity analysis. The appropriate level of gearing is dependent on the nature of the industry. Since information on the industry has not been provided; there may be a possible inaccuracy in determining the appropriateness of the estimates suggested by the finance manager (Madura, 2018). . The projections have also ignored the following facts which may render the estimates of the finance director inaccurate:

- Market price of bonds is determined by a plethora of factors like movements in interest rates which when rise could make the bond prices fall,

- A movement in the inflation rate which when rises causes the bond prices to fall due to erosion in the purchasing power of investors on the investment. On maturity, the bond would earn dollars worth less in present value (Britain, 2013).

Are you also stuck with your APC308 Financial Management calculations? Let us help you. Reach out today- onlineassignmentservices1@gmail.com.

Part D

This section examines whether businesses can reduce their weighted average cost of capital by incorporating a reasonable amount of gearing into their capital structure. Pertinent empirical research in this field of study has also been referenced by our experts while providing these answers.

The traditional theory of capital structure proposes an optimal capital structure wherein it is possible for a Company to increase its value through the gearing. Cost of equity (Ke) will further increase with increased gearing as shareholders will demand compensation for increasing financial risk and bankruptcy risk (Wilson, 2018). Cost of debt (Kd) will increase only at very high gearing levels with increase in bankruptcy risk when expensive equity is replaced with debt beyond the point of optimal capital structure after which cost of equity (Ke) will increase at a rate which will offset the effect of low cost debt and cause increase in WACC (Wilson, 2018). In the real world, the tenets of the Modigliani and Miller theory may still be applicable after incorporation of the bankruptcy risk. This will make it possible for the traditional theory of gearing to hold good wherein an optimal gearing level exist for the firm provided they strategize to reach the optimum trade-off between equity and debt.

If you are looking to buy a bachelor in Accounting and Financial Management Assignment Help, give us a call at +61 871501720 today and get a flat 25% off!

Question 2

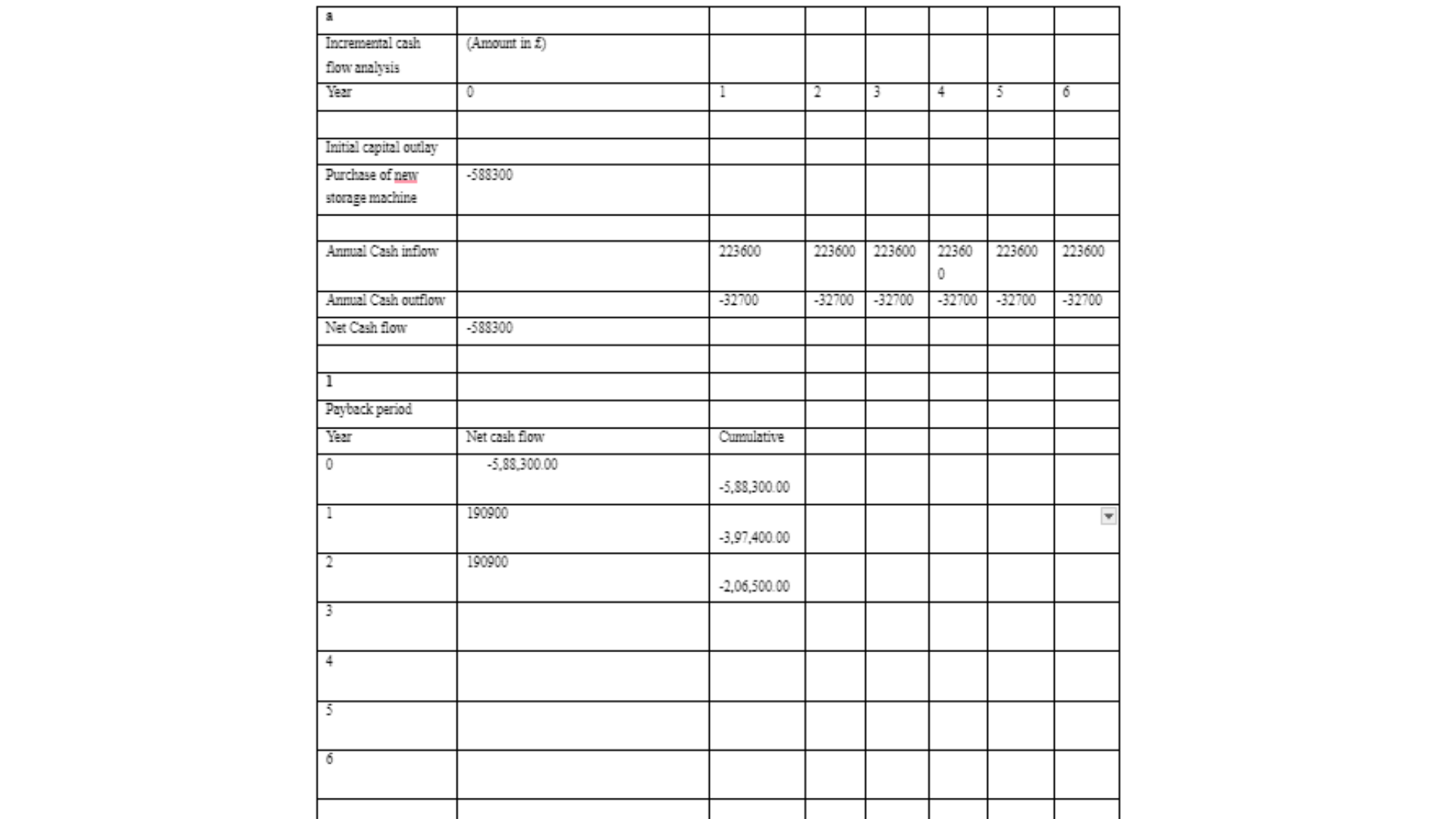

The next case revolves around the fast-food company Newtake Limited, which is considering buying a new storage unit. It is anticipated that the machine will be worth 15% of its initial investment as scrap. For Newtake Limited, the cost of capital is 8%. Considering this and other relevant data provided by the company, the student is supposed to remark on the company’s investment appraisal techniques.

Part A

Here, our highly qualified subject matter experts have deduced the financial viability of purchasing the machine by applying certain investment appraisal procedures, and have offered relevant recommendations, some of which you can read below:

Order APC308 Financial Management Assignment help online and get exciting discounts! WhatsApp us at +447700174710 now.

Part B

As an alternative, it has been suggested that 40% of the total capital expenditure for the aforementioned investment be used to buy back some equity capital, with the remaining investment funds being used to cover cash dividend payments. Using scholarly findings and theories from this field of financial management, the proposals’ implications for the business have been analysed critically by our experts.

The finance director of New take Limited proposes 40% the total capital outflow planned for the project to be used for buying back equity capital and the balance 60% to be used for paying cash dividends. New take management is considering a scrip dividend as an option. Share buyback has been reported to cause a significant enhancement in the value of company shares. However, the buyback must be for the right reasons, with proper implementation. It was also found that the signalling effect of fixed-price tenders is stronger at an average causing 12% appreciation in share price (Pettit, 2001). However, where the buyback is misconceived, it can aggravate the damage. Open-market repurchase is suited where the objective is to distribute excess cash to shareholders in lieu of a dividend but is least effective where the company wants to signal through the buyback that its stock is undervalued(Pettit, 2001).. The buyback will also change the leveraging levels for the company. The buyback may signal that the company has limited new opportunities with a response to a buyback announcement being sale of shares by investors. The declaration of the cash dividend may further strengthen this signal.

If you also need Accounting and Financial Management Assignment Help in UK, mail us at onlineassignmentservices1@gmail.com

Part C

This section examines the three potential funding sources for this idea critically, taking into account pertinent variables in comparison to a publicly traded corporation.

Recent research supports that new equity issues in the United Kingdom have declined after the COVID-19 pandemic. Seed finance available to nascent entrepreneurial start-ups is being preferred (Brown, Rocha and Cowling, 2020). It has also been found that Venture capitalist positively contribute to digital new ventures and scale ups (Cavallo et al., 2019). Based on this evidence, the three proposed sources of finance for a listed company are seed capital, venture capital (VC) and debt. VC will offer the advantages of greater networking, risk bearing willingness and ability, support, no repayments and growth. However, these would also lead to dilution of control (Wilson, 2018).

We provide the best Financial Management Assignment help in London. Don’t believe us? Check it out for yourself! Call us at +61871501720 to know more.

Part D

Lastly, this part critically evaluates the benefits and limitations of each of the different investment appraisal techniques, ensuring the use of relevant academic literature. You can read a snippet of this complete section below:

Net Present Value is simplistic and ensures objective measurement for appraisal of investment projects. It accounts for the time value by converting money from the later time period to the present value with the aid of discounting factor substituted for the cost of capital/hurdle rate/required rate of return (Dai et al., 2022). NPV method is categorically able to point out the liquidity and earning potential of the investment, clearly and comprehensively ensuring incorporation of risk. However, the method may produce false results in projects with high cash flow uncertainty (Huang et al., 2022). It may produce erroneous results where the selected hurdle rate itself does not properly reflect the hurdle capital cost rate/required rate of return. It fails when projects of different sizes are to be compared. Sunk costs are also ignored wherein the method may not be accurate where sunk costs related to the investment were huge. The IRR method simply calculates the rate of earning on investment whichwhen compared with the benchmark or hurdle rate ensures sensible investment appraisal. The IRR also incorporates the time value concept but does not factor the size of the project in its decision. The IRR method can result in multiple values in case cash flow is not in the nature of fixed annuity. The IRR fails to reflect the actual profit. It fails miserably by not incorporating the possibility of future capital injection (Khan and Jain, 2007).

If you are also stuck with APC308 Financial Management Assignment and need Help, reach out to us at onlineassignmentservices1@gmail.com.