TACC602: Accounting for Business Group Assignment Help

Question

TACC602: Financial data for two competitive companies operating in the same industry is provided in the task file. Based on a thorough analysis of this data, the students are required to develop a report assignment for the Australian National Institute of Management and Commerce. This report should present a vertical analysis of the balance sheets and income statements provided in the task. Additionally, a ratio analysis also needs to be done for the aspects of liquidity, solvency, efficiency, profitability, and market perspective. After carefully studying this ratio analysis, the student should assess the financial health and recommend which company’s share will be better for investment purposes.

Solution

The solution presents an in-depth report written by our accounting experts. The solution consists of the following sections- an Introduction, Vertical Analysis, Ratio Analysis, some Recommendations, and lastly a brief Conclusion.

Introduction

The solution begins by providing a brief introduction to the report. Our experts have written an informative introduction to orient the reader to the report.

A financial analysis is a vital tool when it comes to the process of planning and decision making. A financial analysis not only helps in understanding the financial scenario of the company but even helps in the determination of the creditworthiness, profitability and the aspect of wealth generation (Carlon 2019). Moreover, the analysis helps in knowing the health of the health of the company and provides an overview of the taxation aspect. The aim of the assignment is to conduct an insight into the performance of two companies named Panda and Koala.

This constitutes only a small part of the complete introduction written by our experts. If you wish to read more, don’t hesitate to WhatsApp us at +447700174710.

Vertical analysis

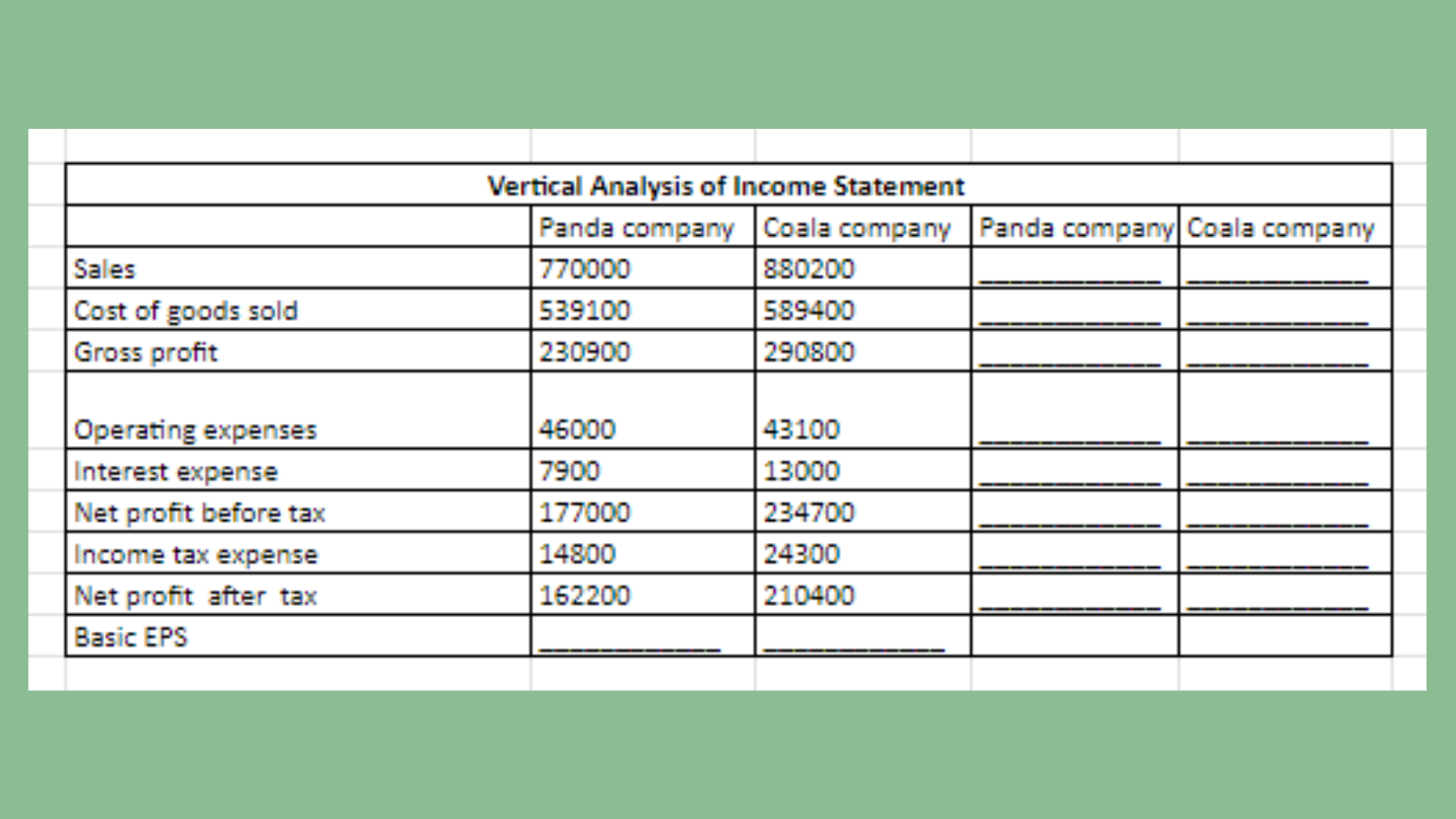

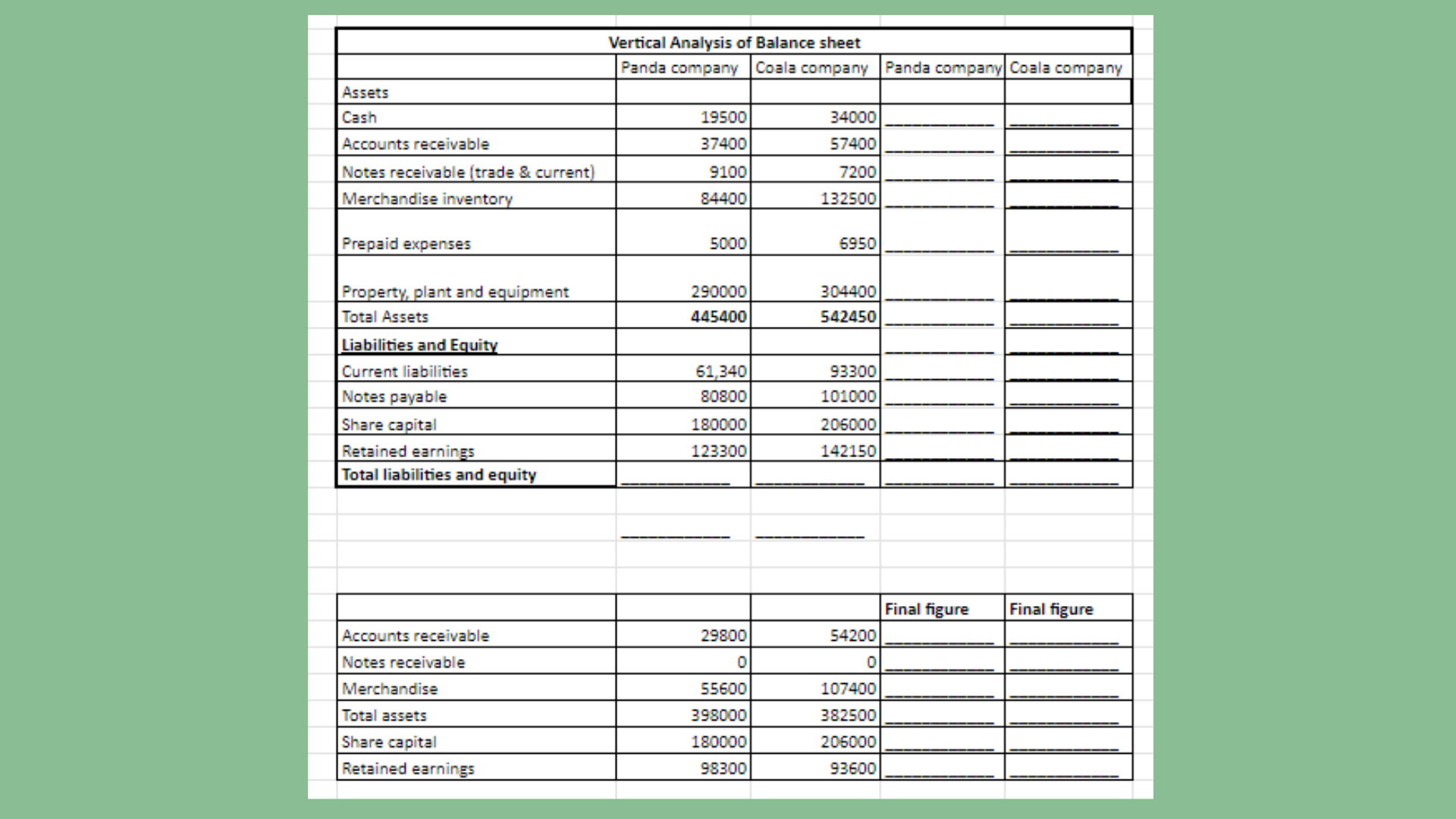

This next section highlights the vertical analysis done by our experts. The income statements and balance sheets were evaluated in detail through appropriate knowledge of the accounting concepts.

Vertical analysis is a potent tool as it helps in the analysis of the financial statements. On the performance of the vertical analysis, each item of the financial statement is entered in terms of percentage for another item (Sherman 2011). For instance, every line item is provided in respect to percentage of gross sales. Moreover, vertical analysis is used for understanding the relative changes in respect to the company’s account for a respective period. This helps in undergoing comparison on a comparative basis. The vertical analysis of Panda and Coala has been done to find out the difference between the two. As per the analysis it is witnessed that that Panda has higher percentage change when it comes to cost of goods sold accounting to 70% as compared to 67% of Coala. This implies change in the sales of Panda Company is higher as compared to Coala. Similarly, change in gross profit of Panda is 30% as compared to Coala where the change in GP is 33%.

We have provided some snippets of a part of the complete table developed by our experts here.

Wish to read the complete section? Wait no more! Mail us at onlineassignmentservices1@gmail.com.

Ratio analysis

A comparison is made by our experts between the financial ratios of the two companies.

Ratio analysis is a quantitative process whereby a proper insight is gained into different parameters of the company such as liquidity, efficiency, profitability and solvency. It is a vital step of conducting an analysis into the fundamentals of the company. Various analyst and investors utilize the method to study, as well as evaluate the fiscal improvement of the company by closely evaluating the statements and the historical performance (Sherman 2015).

Our experts have analyzed the ratio for five factors: liquidity, solvency, efficiency, profitability, and market perspective. Through this analysis, our experts aim to uncover important insights about the two companies which will help in making investment and other related decisions.

-

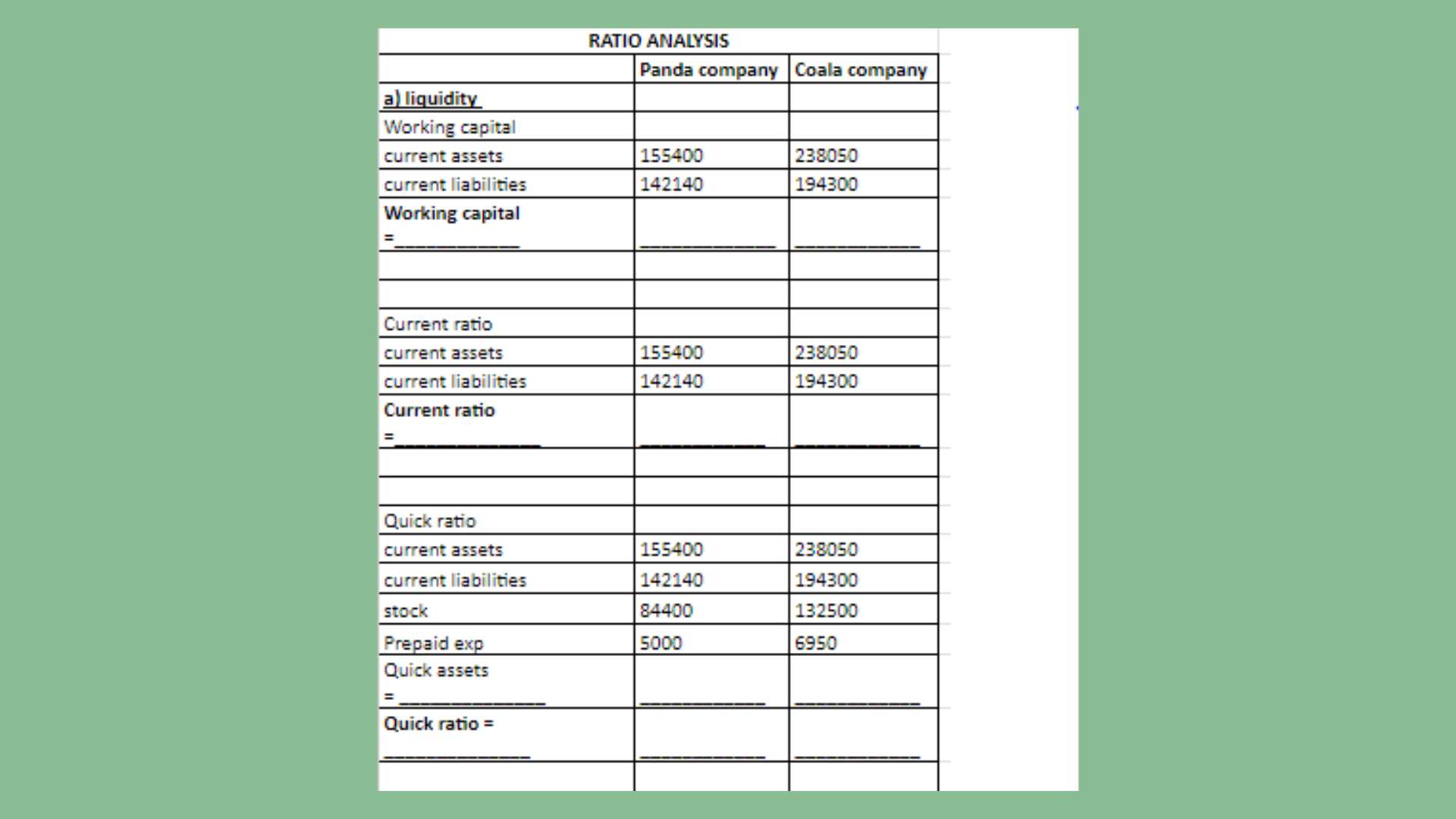

Liquidity

The liquidity ratio helps in ascertaining the efficiency of the business in respect to the settlement of the debts as and when it becomes due with the revenue and assets at the disposal. Liquidity ratio further helps in reflecting the ability of the business in the repayment of the short term obligations (Mersland & Urgeghe 2013). The liquidity in this scenario is indicated with the help of working capital, current ratio and the quick ratio.

Confused about how these calculations were made? Let our experts help you. Call us at +61871501720.

-

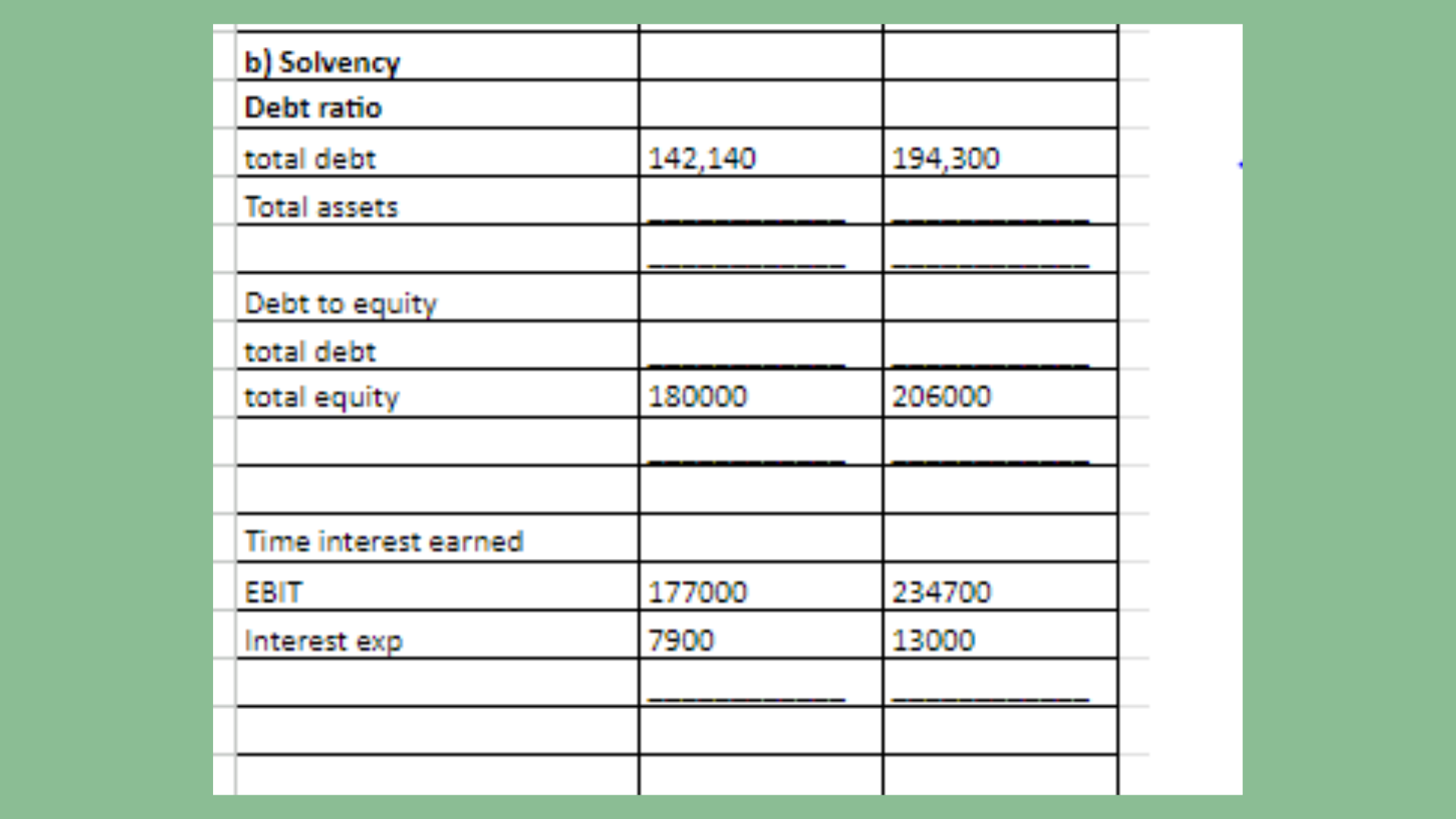

Solvency

The solvency ratio is a metric that enables examination of the financial health of the company. Specifically it helps in the determination of whether the company can meet the financial obligation in the long run (Davydov 2016). Herein, the solvency has been ascertained with the help of debt ratio, debt to equity, and times interest earned.

Want the complete table? Don’t hesitate to WhatsApp us at +447956859420.

-

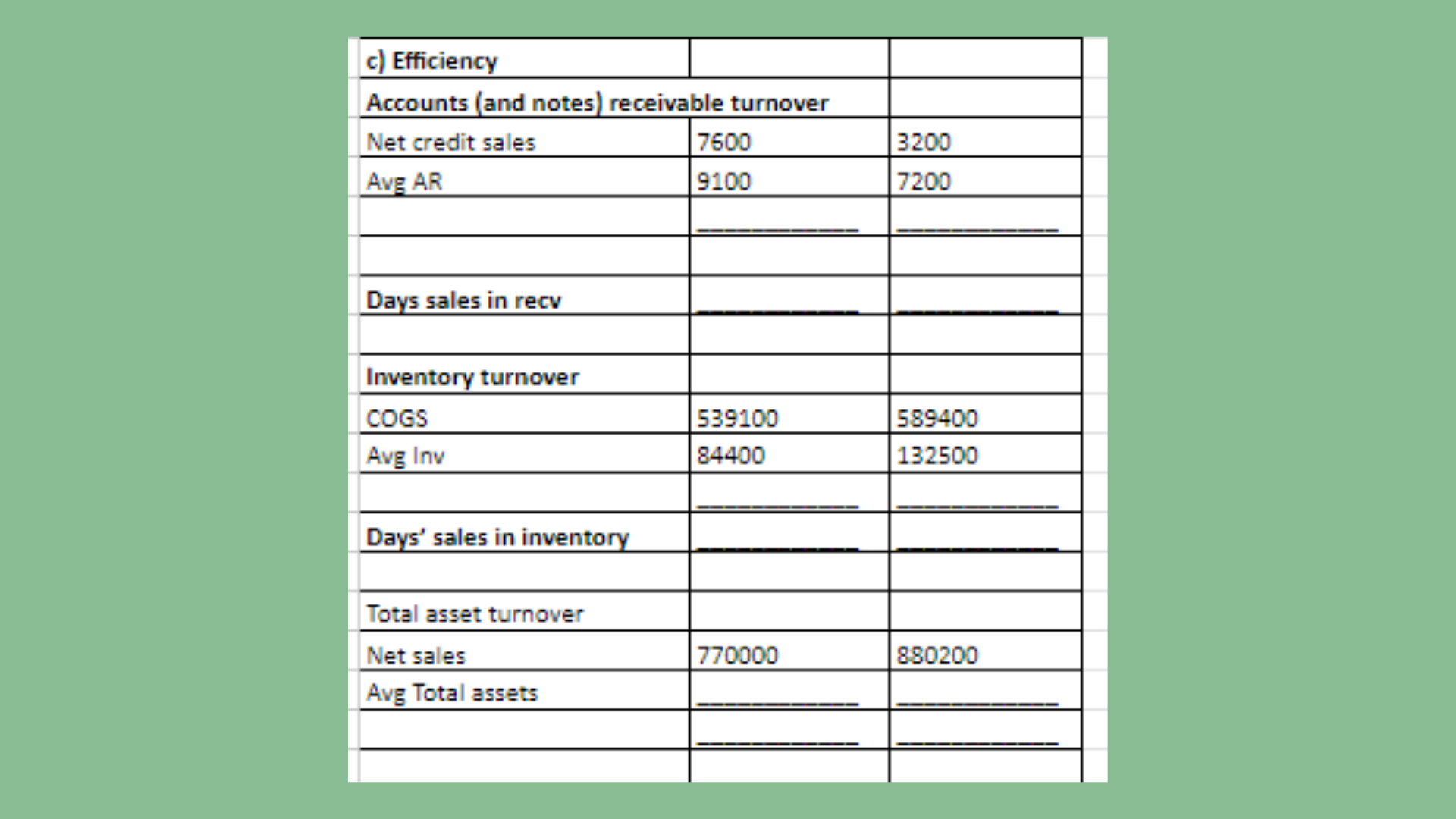

Efficiency ratio

Efficiency ratio indicates the ability of the company to generate revenue with the available resources. As per the computation it is observed that the inventory turnover of Panda is 6 times a year while that of Coala is 4 times. Coming to the inventory days it is observed that Panda Company keeps the inventory for 57 days with itself before releasing the same while Coala is 82 days.

This is only 50% of the complete ratio analysis for the efficiency ratio. To know more, WhatsApp us at +447700174710.

-

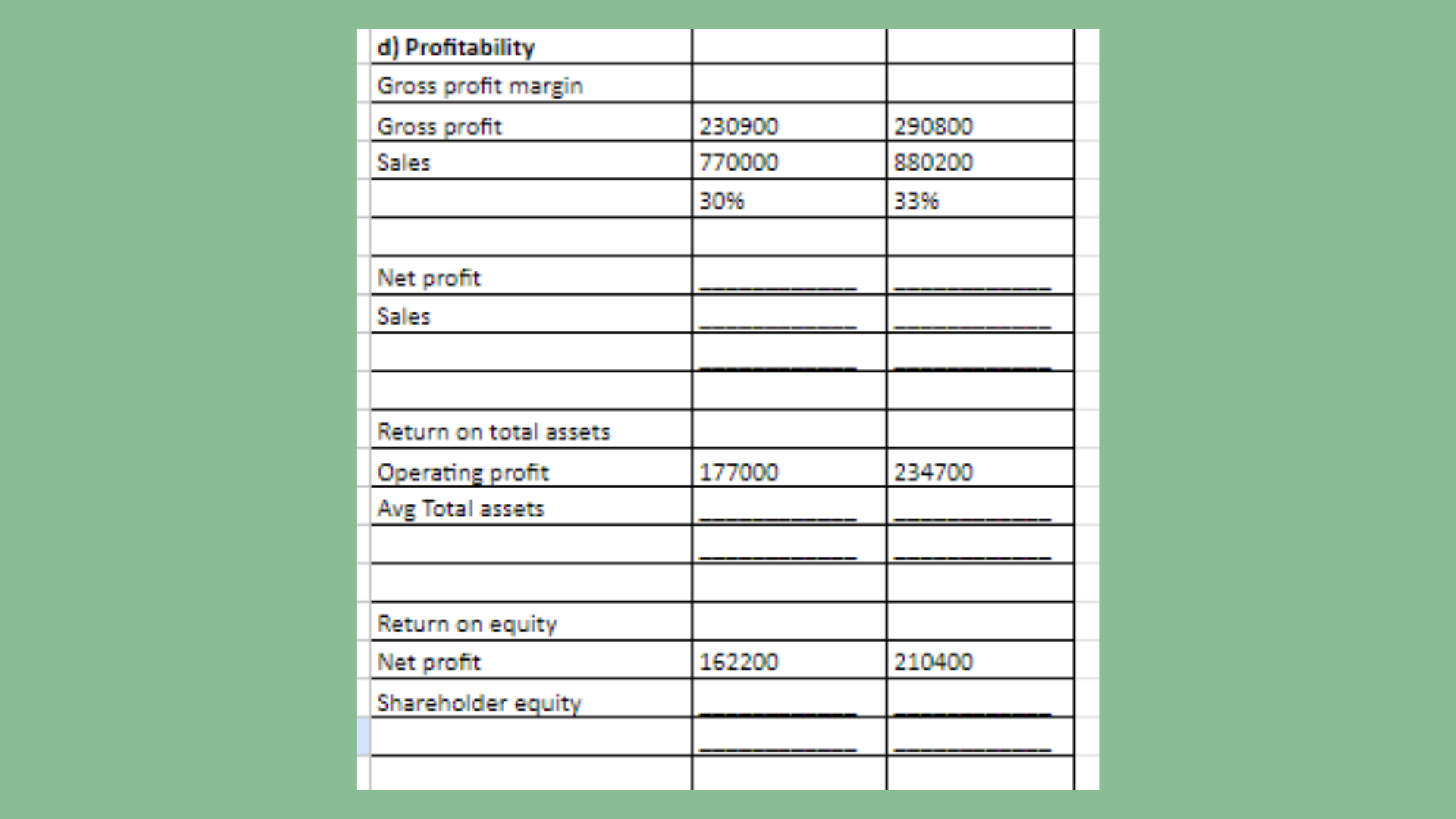

Profitability

Profitability ratios are used for ascertaining the business ability for creating earnings (Sherman 2019). Such ratios can be compared with another competitor for ascertain the performance. Herein, the profitability of Panda and Coala has been done with the aid of gross profit margin, net profit margin, return on total assets and return on equity. The Gross profit of both the companies stands above 30% wherein Coala gross profit margin stands at 33%.

Feeling stuck with profitability ratio analysis? No need to worry, our experts are here to assist you- onlineassignmentservices1@gmail.com.

-

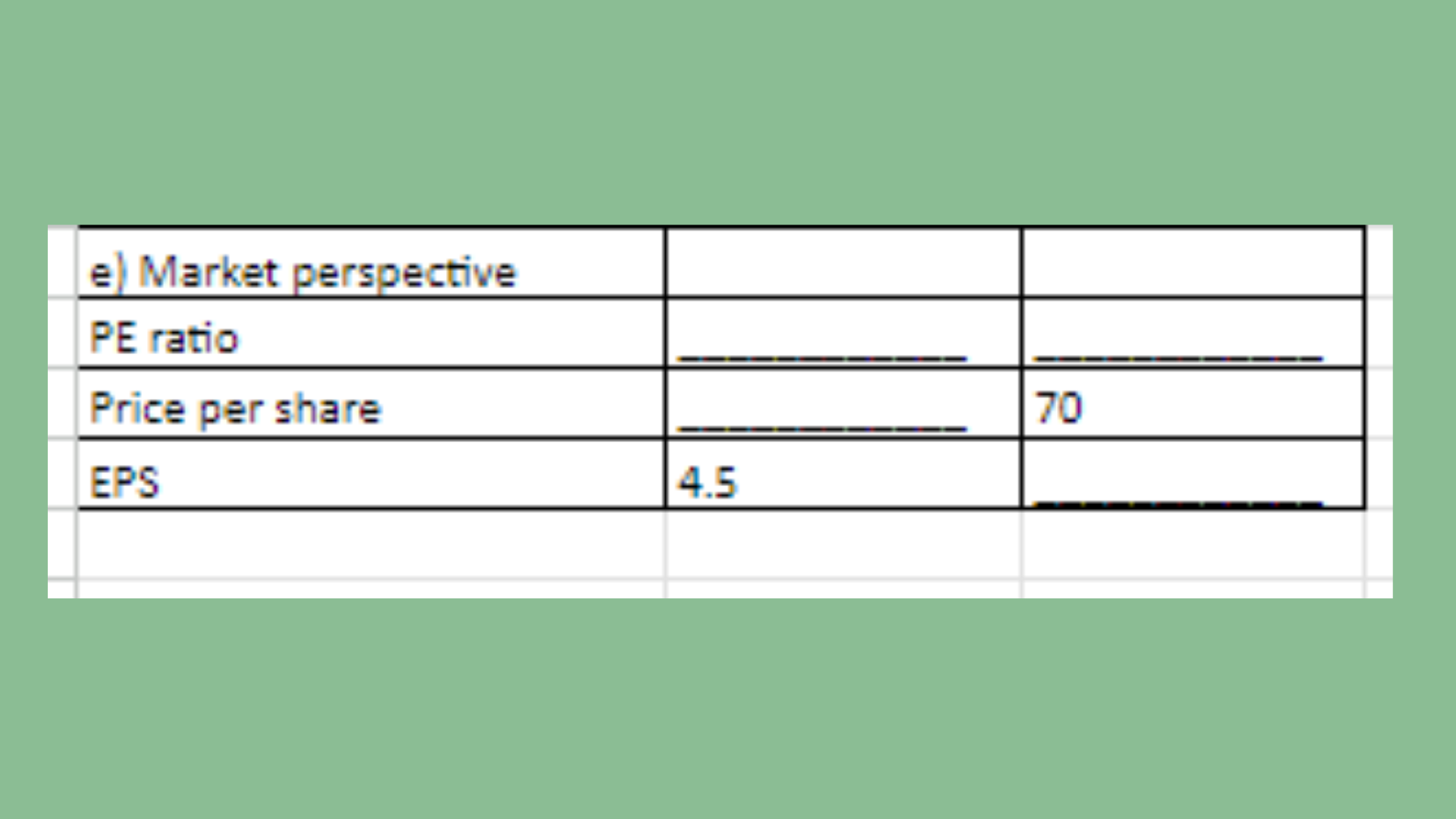

Market ratio

The PE ratio helps the investors in evaluating how much the payment needs to be made on stock based on the current earnings (Davydov 2016). The ratio is utilized to understand the worth of the shares. IN short, the earnings that can be paid are known.

This is only a snippet of the complete answer written by our expert. Call us at +61871501720 to read more.

Recommendations

Our experts have also proposed some recommendations based on the vertical and ratio analysis done above. These are premised on assessing the overall financial health of the two companies.

Based on the above discussion it can be commented that Coala Company is better for the investment purpose. The company has a strong EPS of $5.11 and other parameters are strong for the company such as working capital and current ratio which indicates the company can easily repay the debts.

Did you like the recommendations proposed by our experts? Reach out to us today to read all the recommendations- onlineassignmentservices1@gmail.com.

Conclusion

Lastly, our experts have summarised the entire findings that were revealed during the analysis of the financial information of the two companies.

The overall analysis indicates that both the company Panda and Coala has performed effectively. The profitability, liquidity and market perspective of both the companies are strong. The only area that requires the management attention is the debt equity and accounts receivable ratio.

If you also need assistance with your financial analysis assignment, don’t hesitate to WhatsApp us at +447700174710.