ACCT6004: Business Case Studies Assignment Help

Question

ACCT6004: This case study-based assignment requires the students to analyse the financial data for the provided case of The Lego Group. The students are supposed to provide a spreadsheet which should include the financial analysis for the company. Additionally, a memo is also to be submitted addressing the CEO of the organisation. The memo should entail all the important findings from the financial analysis as well as some recommendations for the specified project.

Solution

The solution incorporates two parts- A financial analysis spreadsheet for The Lego Group and the memorandum.

Please keep reading to know how our experts have done the financial analysis for the organisation. Our experts have reviewed the expected cash flows for the company including the potential for uncertainty. The base case analysis has been done through the five criteria related to the investment decisions which are provided to us in the case study for the organisation.

We have provided the financial analysis for only two years. Wish to read the complete financial analysis? Call us at +61 871501720 today.

Another part of this assessment includes a memorandum to the organization’s CEO. Please keep reading to know how our experts have written the memorandum.

The first part mentioned in the memorandum points out the Incremental Cash flow analysis done by our experts.

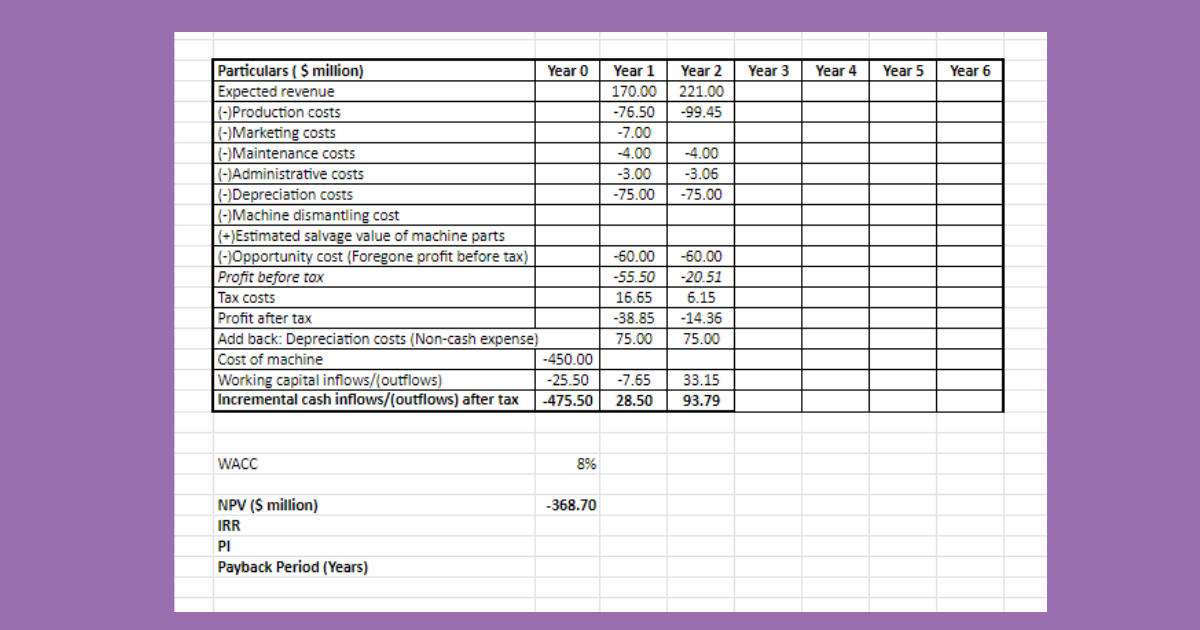

Incremental Cash Flow Analysis (Base Case)

In this analysis, only the relevant cash flows need to be considered. The $1.5 million spent on the feasibility study would be sunk cost since irrespective of the decision, this cost cannot be recovered. Similarly, the R&D costs of $5 million spent on product development cannot be recovered. Thus, these costs are irrelevant and not considered in the incremental analysis conducted for the project (Petty et. al., 2016).

The relevant incremental cash flows include revenue from the sale of new products, underlying costs such as production costs, marketing cost, administrative cost and any additional cost in the form of impact on existing business. For instance, there is a loss of income associated with the current project since it would reduce the pre-tax earnings of $120 million to $60 million each year. This loss is relevant since it is linked with the BIOLego project and can be avoided if this project is not pursued.

This is only half of the solution written by our experts. Please WhatsApp us at +447956859420 to know more.

The next part presents the uncertainty analysis done for The Lego company. Our experts assure accurate and structured analysis, a snippet of which you can read below.

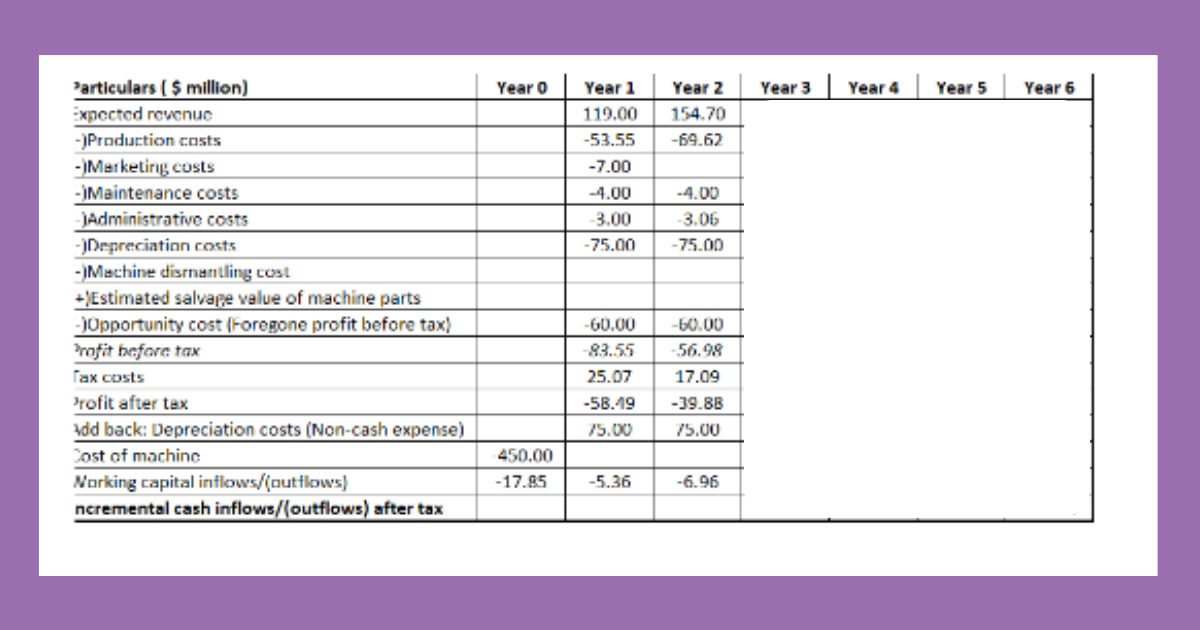

Uncertainty Analysis

Considering the large uncertainty associated with the estimation of revenue, it is imperative to undergo an uncertainty analysis so as to ascertain the impact of this uncertainty on the overall financial viability of the project. Based on the information provided, there is relative certainty with regard to the other project parameters and thereby the key source of uncertainty is the projected revenue.

The NPV in the various cases has been summarised and presented in the following table.

| Scenario | NPV ($ million) |

| Base | _____________________ |

| Optimistic | _____________________ |

| Pessimistic | _____________________ |

Here, we have provided only 50% of the uncertainty analysis done by our experts. If you wish to read the complete analysis, please don’t hesitate to mail us at onlineassignmentservices1@gmail.com.

Lastly, our experts have written well-researched recommendations for the Lego company based on the financial analysis of the company.

Recommendations

Based on the base case analysis, it is recommended that the underlying project is financially feasible. The key reasons for this recommendation are as follows (Atrill, McLaney & Harvey, 2017).

- NPV of the project is $69.43 million. Since the NPV of the project is positive, hence the project is financially viable and would lead to value creation for the shareholders.

- IRR of the project is 11.20%. Since the IRR of the project is greater than the WACC (8%), hence it is financially viable.

- The PI of the project is 1.15 and hence greater than 1.

If you also need assistance with your financial analysis assignment, don’t hesitate to WhatsApp us at +447700174710.