ACCT6001: Company and Financial Reporting Assignment Help

Question

ACCT6001: A financial report needs to be developed to complete this assignment. The students are required to imagine themselves in the role of a group accountant working for MQE Ltd, which is a company based in Australia. As a group accountant, the student needs to prepare a report as per the financial information highlighted in the company’s annual report for the year 2022. The transactions and data till 30 June need to be analyzed by the student. The student is supposed to answer the particular questions provided in the assignment based on this analysis. The questions revolve around the nature of transactions highlighted in the annual report, applicable accounting standards and disclosures, as well as adjustments if required.

Solution

The solution incorporates clear and concise answers to each of the questions provided in the assignment file. The solution is divided into two parts- Part A constitutes questions about the Events and Transactions in the annual report for the company, while Part B is based on how these transactions need to be analyzed and treated for the particular company.

Part A

Events/Transactions

Question 1

In question 1, the scenario of fire damage needs to be analyzed. It is remarked that the fire has led to damage of warehouse items costing a loss of around 2 million dollars. Additionally, the insurance claim is not done yet which the company has no reason for. Our experts have answered all four requirements about the nature of transactions, applicable accounting standards, Disclosure requirements, and Adjustment to be made to the financial statements, half of which you can read below:

- Nature of the transaction: the event is indicative of favourable conditions that arose after the reporting date termed as non-adjusting events after the reporting date.

- Applicable accounting standard: AASB 110 Events after the reporting date which provides guidance on those events that take place between the reporting date and the issue date of the financial report.

- Disclosure requirements: Material or significant non-adjusting events after the reporting date are required to be disclosed as these could influence the economic decisions of users relying on the financial report. So disclosure of the nature of the event with estimate of its financial effect, or the fact that such an estimate cannot be made is required as per paragraph 21.

- Adjustment to be made to the financial statements: The Company is not required to adjust the amounts in connection of these events in its financial after the reporting date.

Wish to read more? Call us at +61871501720 today.

Question 2

Following a case of bad debt from a customer who suffered financial losses due to COVID-19 issues, MQE Ltd had been notified that the debt will be settled. The balance prior to this settlement is provided, and the student is supposed to answer all four requirements for this particular scenario.

- Nature of the transaction: the event is indicative of favourable conditions that arose after the reporting date termed as adjusting events after the reporting date.

- Applicable accounting standard: AASB 110 Events after the reporting date which provides guidance on those events that take place between the reporting date and the issue date of the financial report. The company is required to adjust the amounts in connection of these events in its financials after the reporting date as they do relate to conditions at the reporting date.

- Disclosure requirements: The disclosure note will be on the following lines:

In the prior financial year, $550,000 was written off in respect of an overseas customer as it was not likely to be recoverable and a provision was provided.

- Adjustment to be made to the financial statements: Credit provision for bad debts written off.

Confused about how our experts calculated these aspects? Let us help you. Reach out today- onlineassignmentservices1@gmail.com.

Question 3

In the third question, it is mentioned that the Australian Government has provided around 500,000 dollars to the company on some conditions to help the business to retain the employees working in the company. One of these conditions include that the business profits do not fall below 20%, which does not hold true for the company for the present financial year. The government is skeptical regarding the legislations which might be passed to mandate returning of the Job Keeper money if the profits fall short.

- Nature of the transaction: the event is indicative of an error in applying accounting regulations which was noted after the reporting date termed as adjusting events.

- Applicable accounting standard: Government grants are accounted for as change in accounting estimate under AASB 108.

- Disclosure requirements: The Company is required to adjust the amounts in connection of these events in its financials after the reporting date as they do relate to conditions at the reporting date.

- Adjustment to be made to the financial statements: Credit job keeper payment receivable and debit government grant income with $ 500,000.

Curious about complete calculations? Wait no more, and WhatsApp us today at +447700174710.

Question 4

The fourth question presents a case where after suffering huge financial losses due to the fire, MQE now aims to renegotiate its contracts with the suppliers. The use of labour hiring services for warehouse is one of these renegotiating factors. Among the many quotes received for the labour hiring services, MQE has accepted the offer from Here to Help Pty Ltd. The answers written by our experts are highly accurate and demonstrate an in-depth understanding of the subject as well.

- Nature of the transaction: the event is indicative of conditions that arose after the reporting date termed as non-adjusting events.

- Applicable accounting standard: AASB 110 Events after the reporting date which provides guidance on those events that take place between the reporting date and the issue date of the financial report.

- Disclosure requirements: Material or significant non-adjusting events after the reporting date are required to be disclosed as these could influence the economic decisions of users relying on the financial report. So disclosure of the nature of the event with estimate of its financial effect, or the fact that such an estimate cannot be made is required as per paragraph 21.

- Adjustment to be made to the financial statements: No adjustment is required in the financial statements.

Do you also feel stuck with your accounting assignment? Don’t hesitate to WhatsApp us at +447956859420.

Question 5

This next question highlights MQE’s new golf club design for which it took around 65,000 dollars for researching its applicability to the golf clubs and to assess whether they improve the golf club or not in the first place. Based on the results, MQE have decided to go ahead with this patent which will be applicable for three years, with its patent cost amounting to around 15000 dollars. Its marketing and advertising has also begun and through analysis of the cash flow financial informations, a net present value for this new initiative is provided to be around 1.5 million dollars. Through carefully, analysing the case, our experts have demonstrated an application of modules taught in the class for the course as well.

- Nature of the transaction: the events are adjusting as well as non-adjusting in nature.

- Applicable accounting standard: AASB 138 will apply separately to the adjustment and disclosure for research and development expenditure, patent costs and marketing expense. Research expense and marketing expense will be recognised as an expense.

- Disclosure requirements: Disclosures with respect to revenue will include details on the contracts, judgements exercised in this context and any asset recognized. Disclosures with respect to research and marketing will include an aggregation of the total amount. Disclosures with respect to development expenditure and patent include gross carrying amount, useful lives, and amortization methods.

- Adjustment to be made to the financial statements: Credit to research and development and debit cash for $ 65,000, Credit to marketing and debit cash for $ 30,000.

Did you like the answer written by our experts? This is only half of the answer. To get the complete answer, reach out to us today- onlineassignmentservices1@gmail.com.

Part B

Question 6

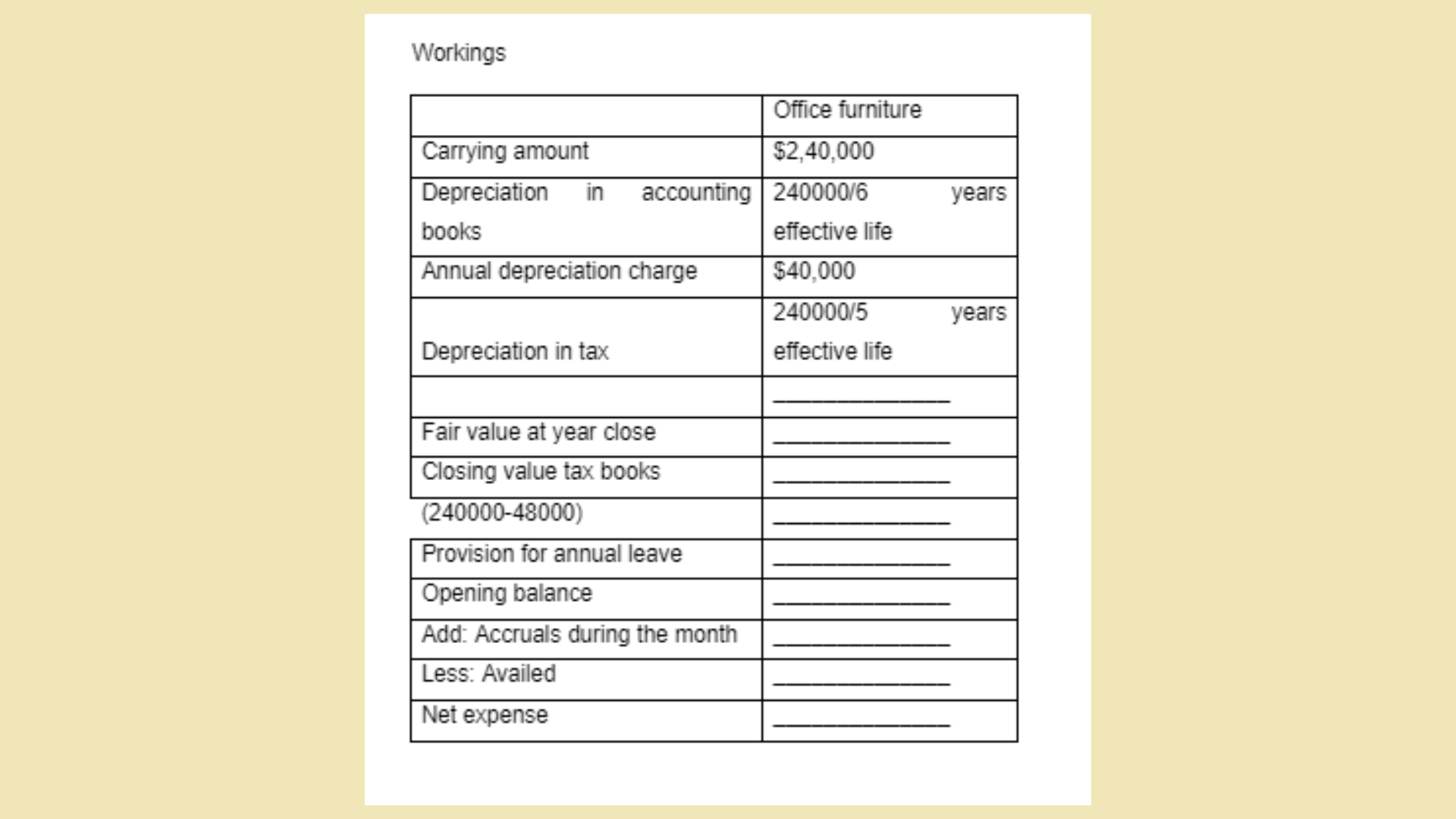

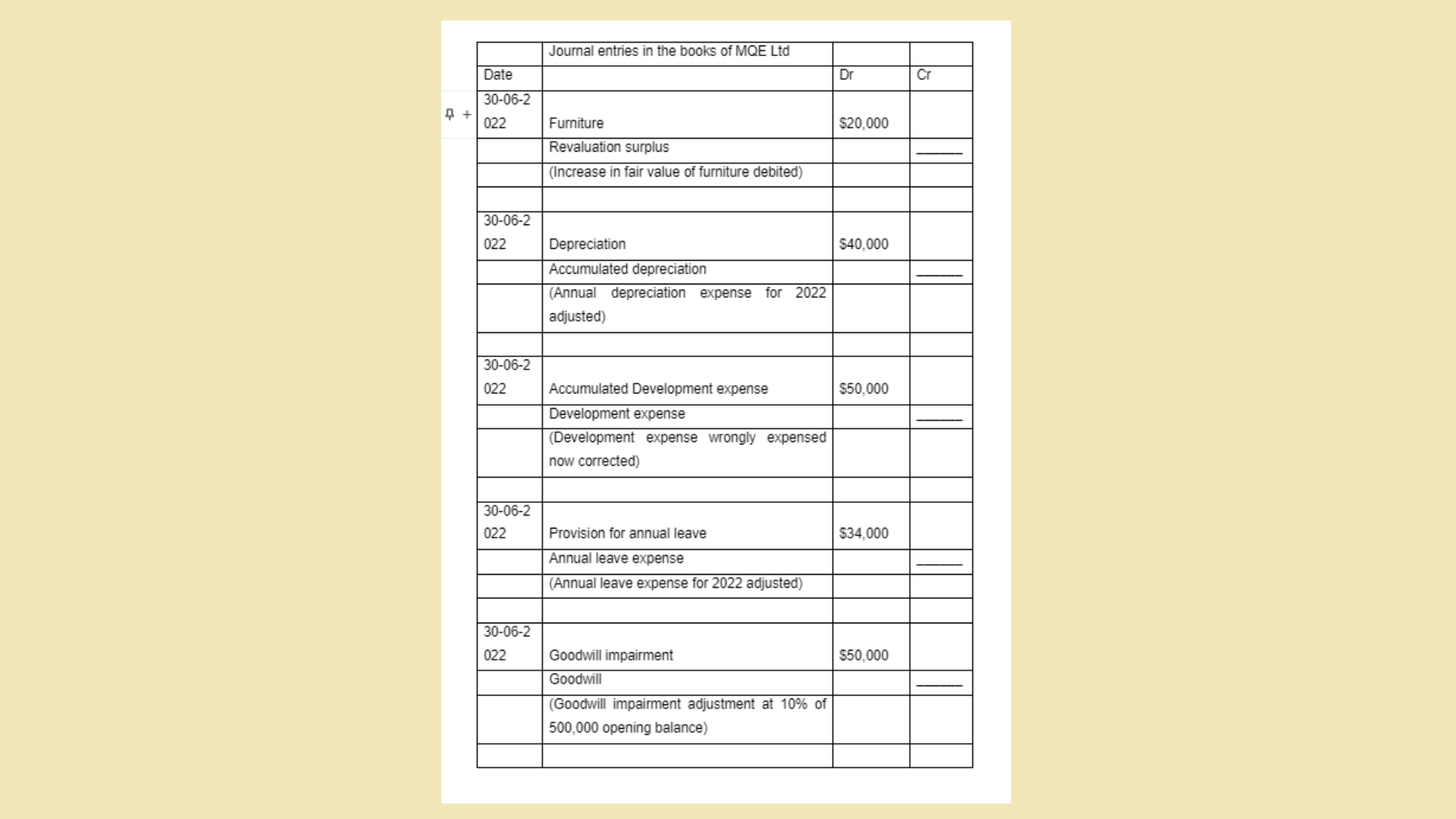

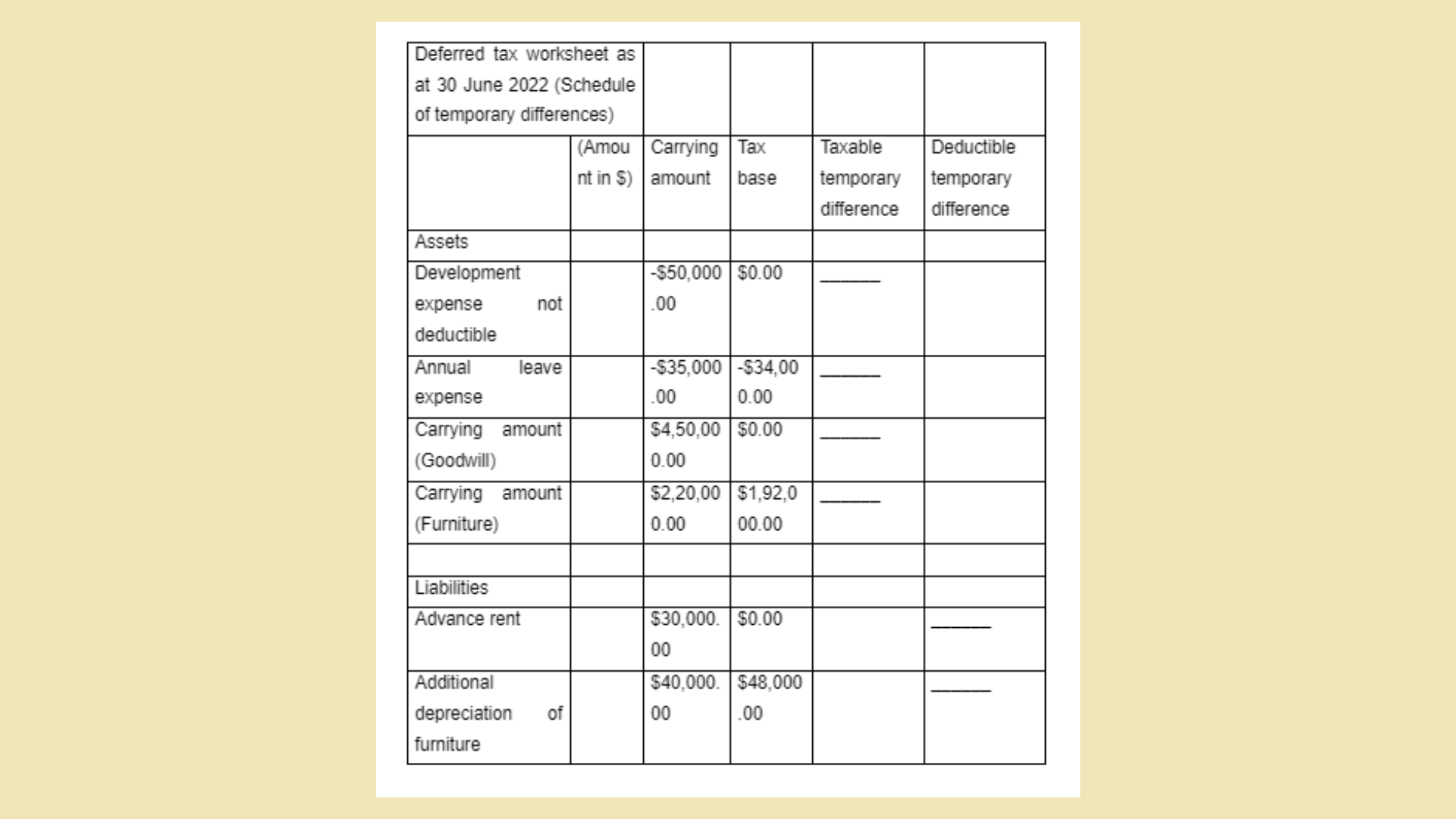

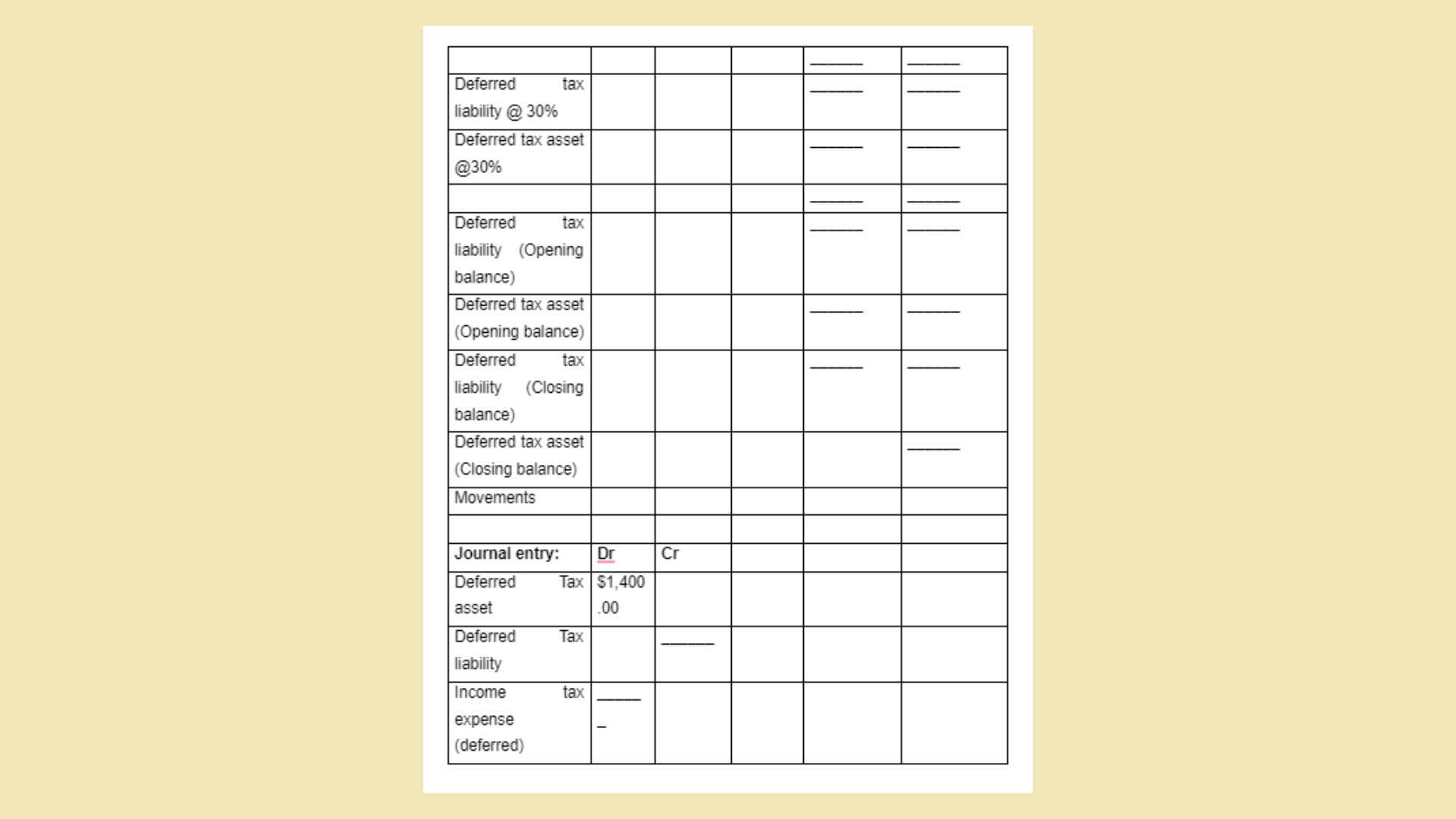

This question is based on the transactions that took place during the financial year of 2021. Based on the influence of these transactions on the DTA and DTL accounts, our experts have provided applicable journal entires for the mentioned transactions. Our experts have developed a table incorporating portraying all the accurate calculations related to the workings, and final journal entries.

We have provided only half of the table here. You can WhatsApp us to get the complete table- +447700174710.

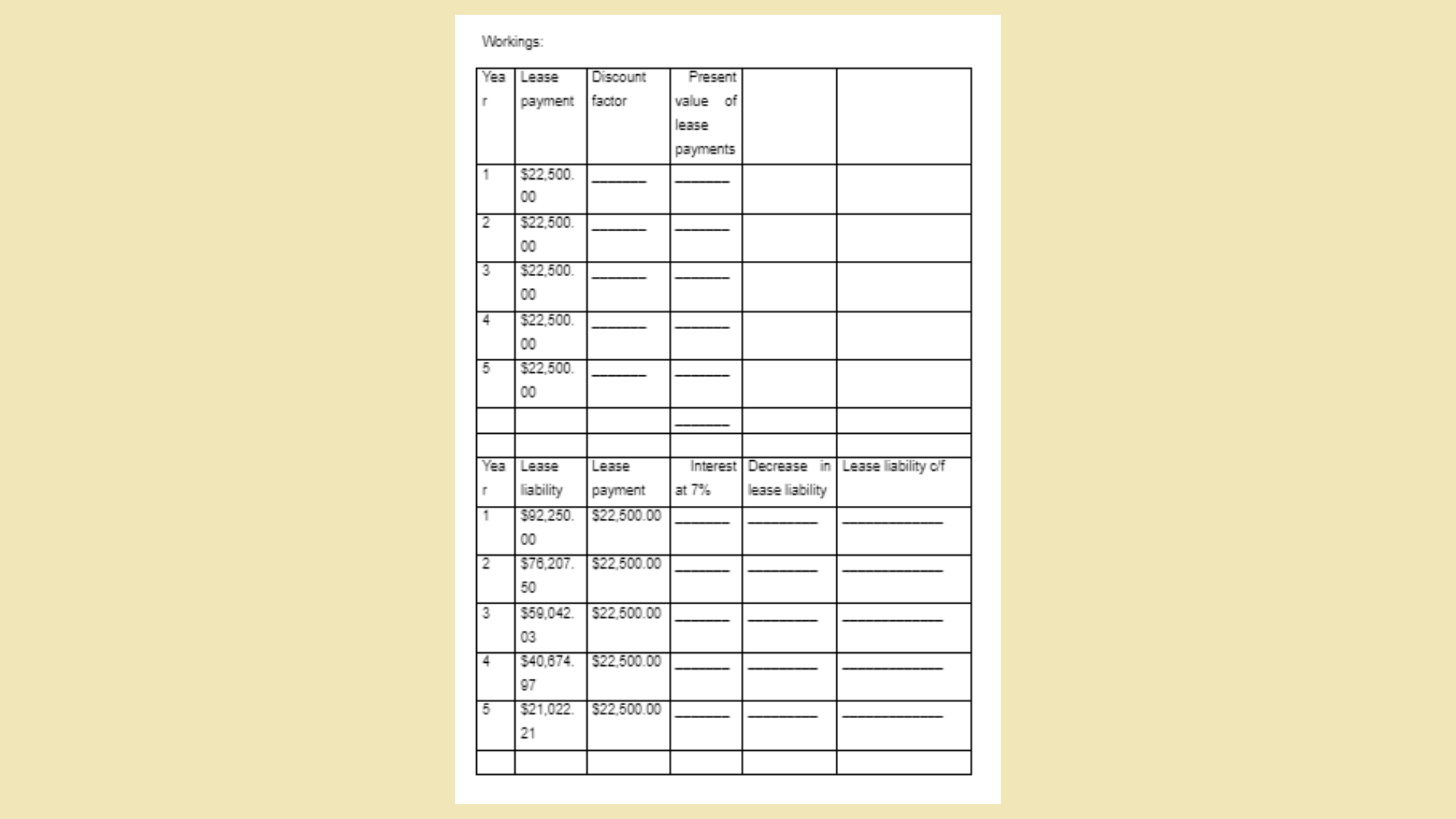

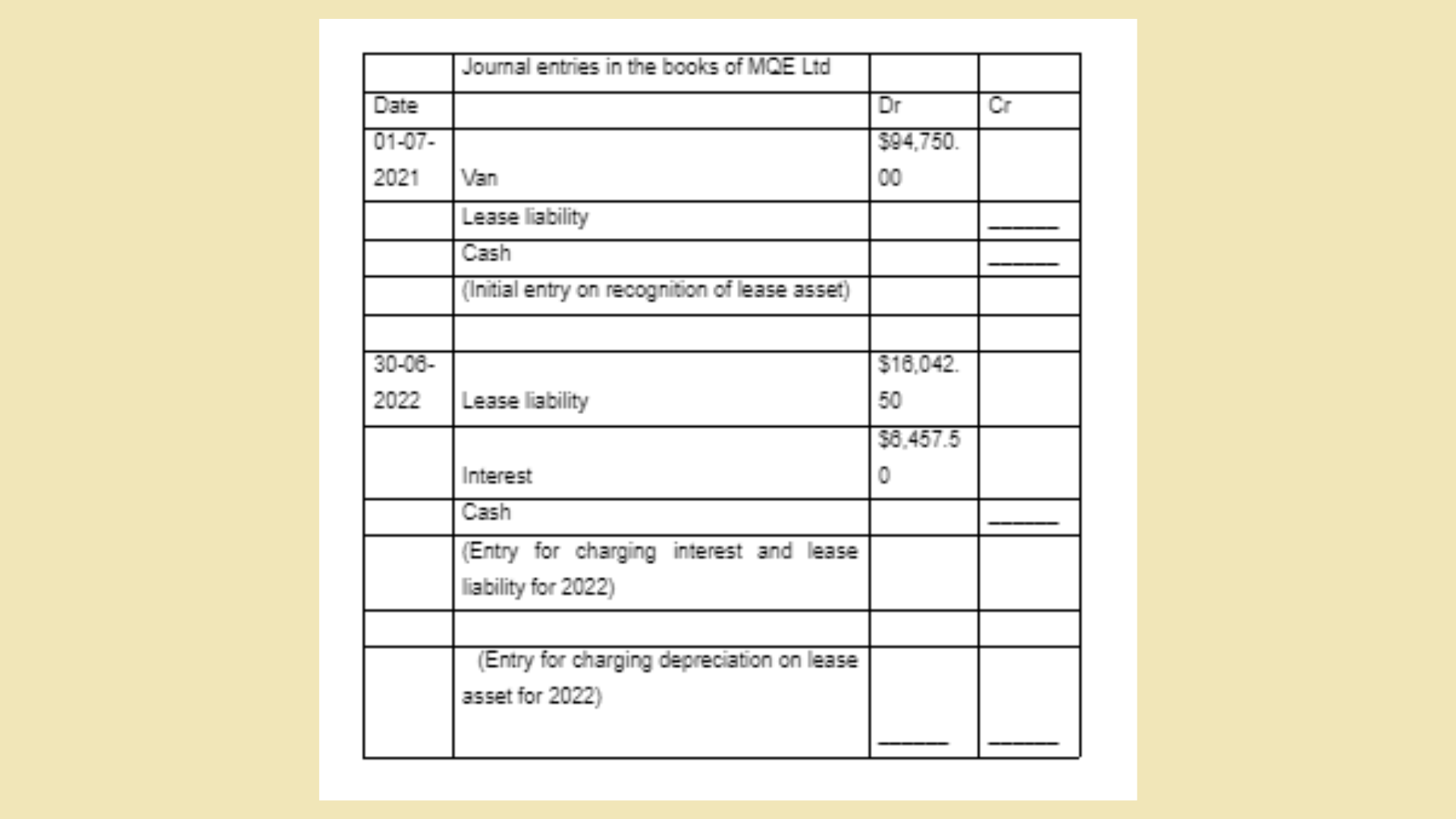

Question 7

In the last question, it is remarked that MQE have rented out a Mercedes van for the purpose of moving inventories on the Gold Coast. MQE aims to keep the van beyond its lease period which is five years, however it is not yet discussed with the renter Robina yet. Based on this analysis and understanding from the module about accounting stnadrards, our experts have made the journal entires for the year 2022.

The closing liability is $76,207.50. Refer working for details.

The lease in this case is an operating lease as per AASB 16 as the user has access to the van for a fixed time period of 5 years in return for making regular monthly lease rental. MQE can use the van for the full term of the agreement.

Interested in reading more about this? Wait no more, and call us at +61 871501720 today.