ACC30010: Auditing Assignment Help

Question

ACC30010: This is a Bachelor of Business Accounting assignment help for the Swinburne University of Technology which demands the students to demonstrate their knowledge related to the planning of revenue audits. The assignment requires the students to imagine themselves in the role of a senior auditor for an auditing firm Teeter & Terrel, who is responsible for auditing the revenues of a new client Lokka Mart. The student is supposed to analyze the revenue data provided and create visualizations to spot possible problems that need to be investigated further during the main audit.

Solution

As the student is required to pay close attention to the revenue statements in particular, the Bachelor of Business Accounting students frequently require assignment help for this particular assessment. OAS takes extreme pride in delivering quality assured business assignment help to students at very affordable prices.

The Auditing solution is divided into five sections- a brief Introduction, an Analysis of ‘Accuracy’ Assertion, an Analysis of ‘Occurrence’ Assertion, an Analysis of ‘Cut-Off’ Assertion, and lastly an Analysis of ‘Completeness’ Assertion.

Introduction

The solution to this ACC30010 begins with a brief introduction of the purpose of writing this report, a snippet of which you can read below:

The purpose of this official report is to provide a planning audit of income, check to see if Lokka Mart entity audit risks can be defined, and uncover proof that Lokka Mart provided false information. Select the appropriate audit strategy for the entity as a result to reduce audit risks and time.

This study provides a complete analysis of the sales’ periodicity and the deceptive materials, together with data virtualizations that pertain to Lokka Mart’s information.

There are three primary sections of the report, which are as follows:

- The following criteria are used to analyse and support audit procedure assertions: precision, thoroughness, cut off, classification, and occurrence. The Lokka Mart audit strategy that is appropriate.

- ______________________________________________________________________________________________________________________________________________________________

Want to buy ACC30010 Auditing assignment help in Melbourne? Reach out at onlineassignmentservices1@gmail.com.

A1. Analysis of ‘Accuracy’ Assertion

The first section of this solution presents an analysis of accuracy in association with the dataset provided for Lokka Mart. While providing Bachelor of Business Accounting assignment help to the students, our experts have organized this section according to the structure recommended in the assessment file. This is how our expert ensured that all the aspects were answered which included the visualisation of data anomaly with respect to the accuracy assertion, followed by an elaborative discussion of the same.

- Justification for the ‘accuracy’ claim in relation to Lokka Mart: According to Isabel Pedrosa, Carlos J. Costa (2012) Nowadays, practically all audit operations involving data extraction and analysis are supported by computer-aided audit tools (and techniques).

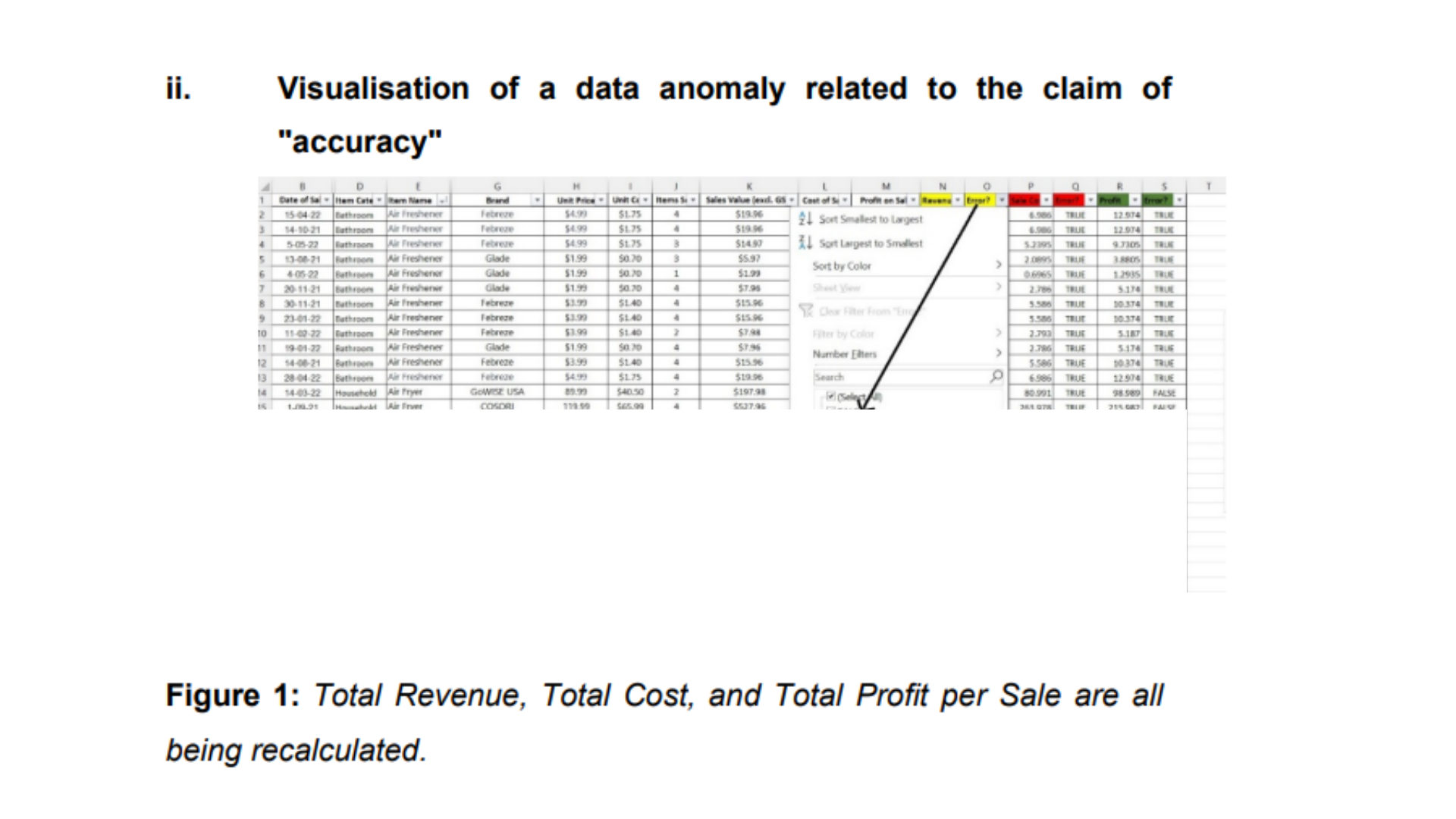

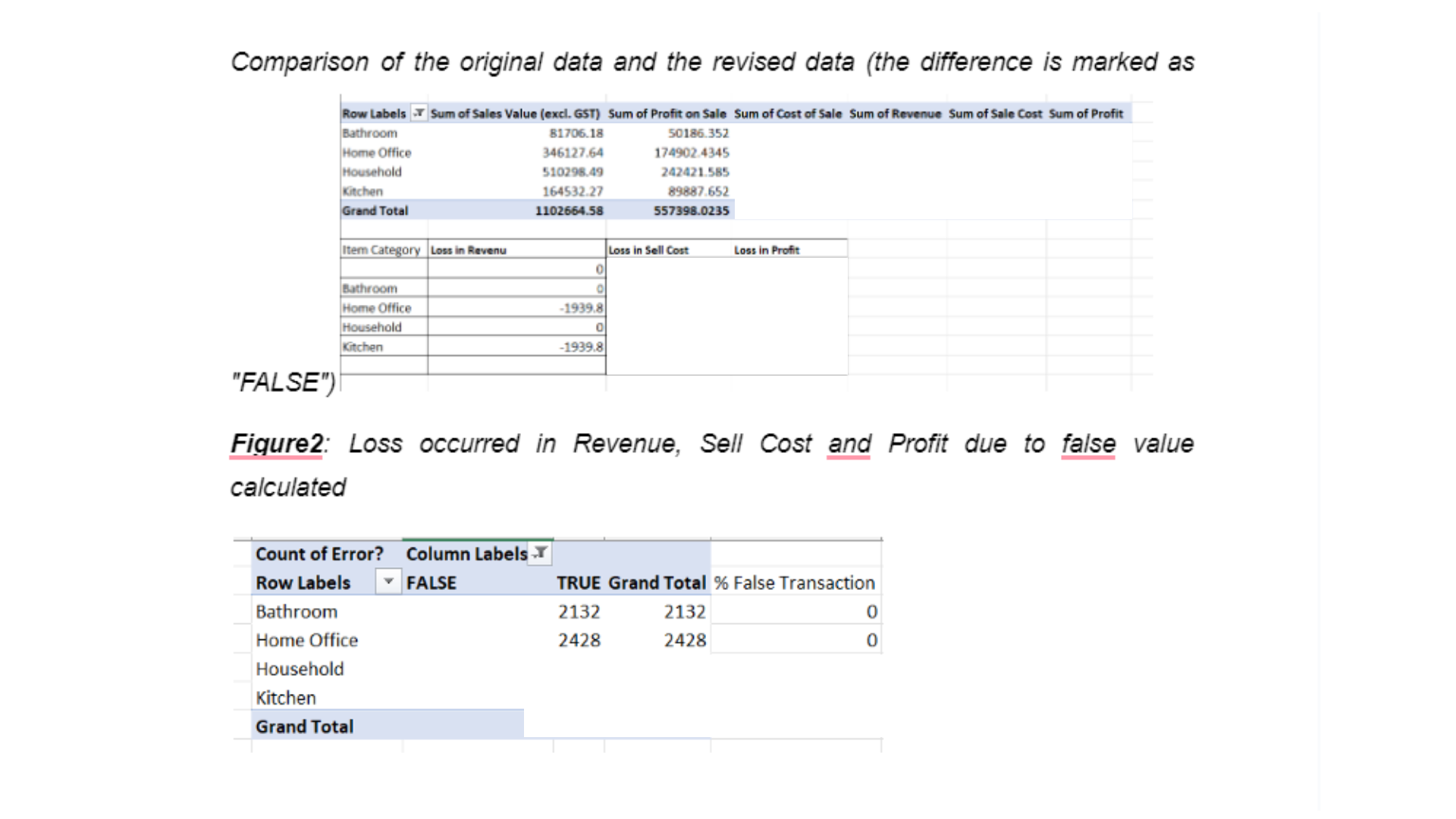

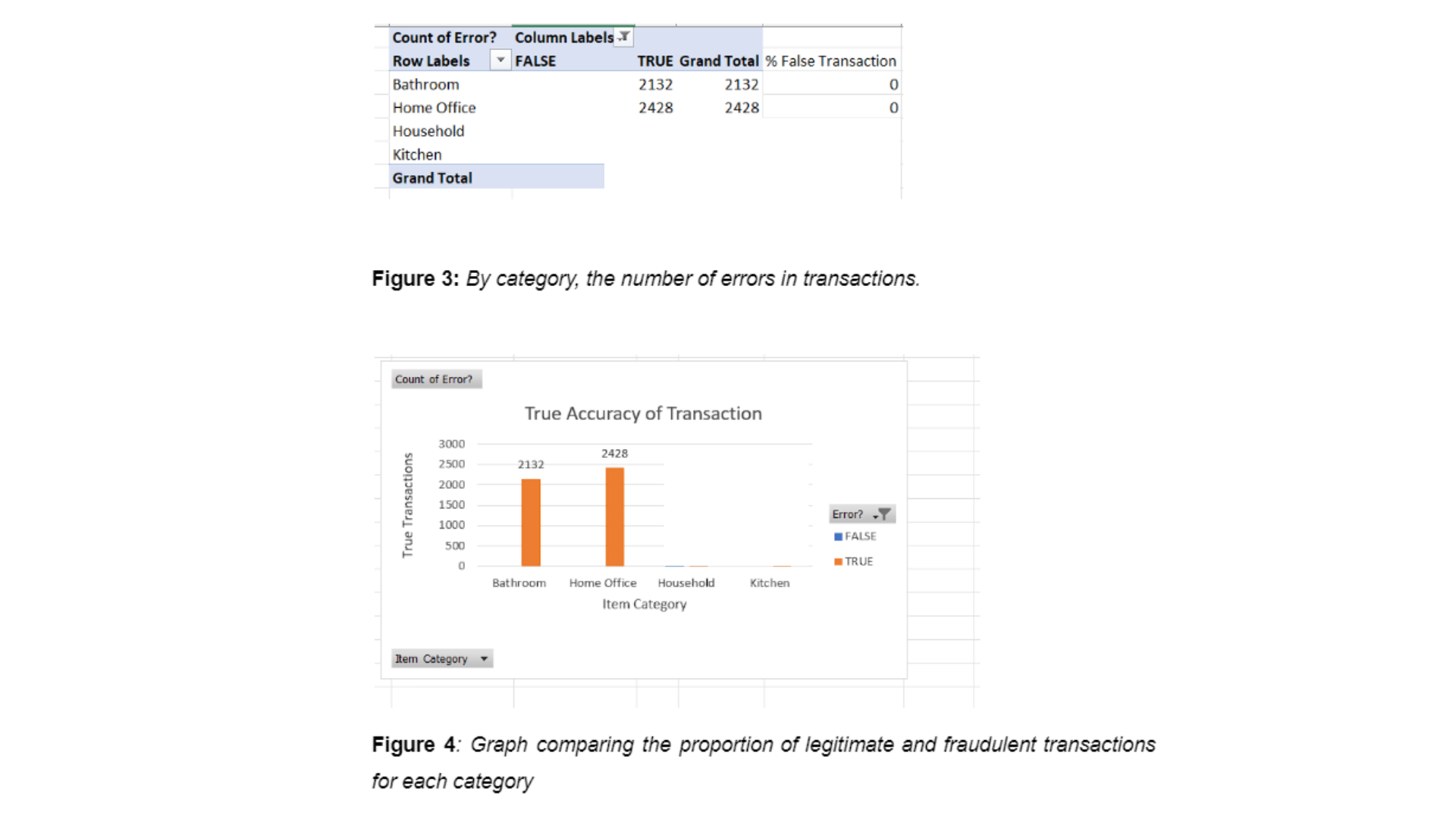

- Visualisation of a data anomaly related to the claim of “accuracy”:

iii. Discussion, interpretation of results, and data visualisations are needed, as well as follow-up (accuracy assertion):

In finance, the term “accuracy” refers to the correctness or precision of financial calculations, forecasts, or models. Excel, being a widely used tool in finance, can be employed to analyze and assess accuracy in various ways. Here’s a short explanation of how Excel can be utilized for this purpose:

- Input Data: Excel allows you to input financial data, such as historical prices, transaction records, or economic indicators, into its spreadsheet format. Ensuring accurate and complete data entry is the first step toward achieving accuracy in financial analysis.

Get Social work assignment help in Armidale at flat 20% Off! Reach out at onlineassignmentservices1@gmail.com.

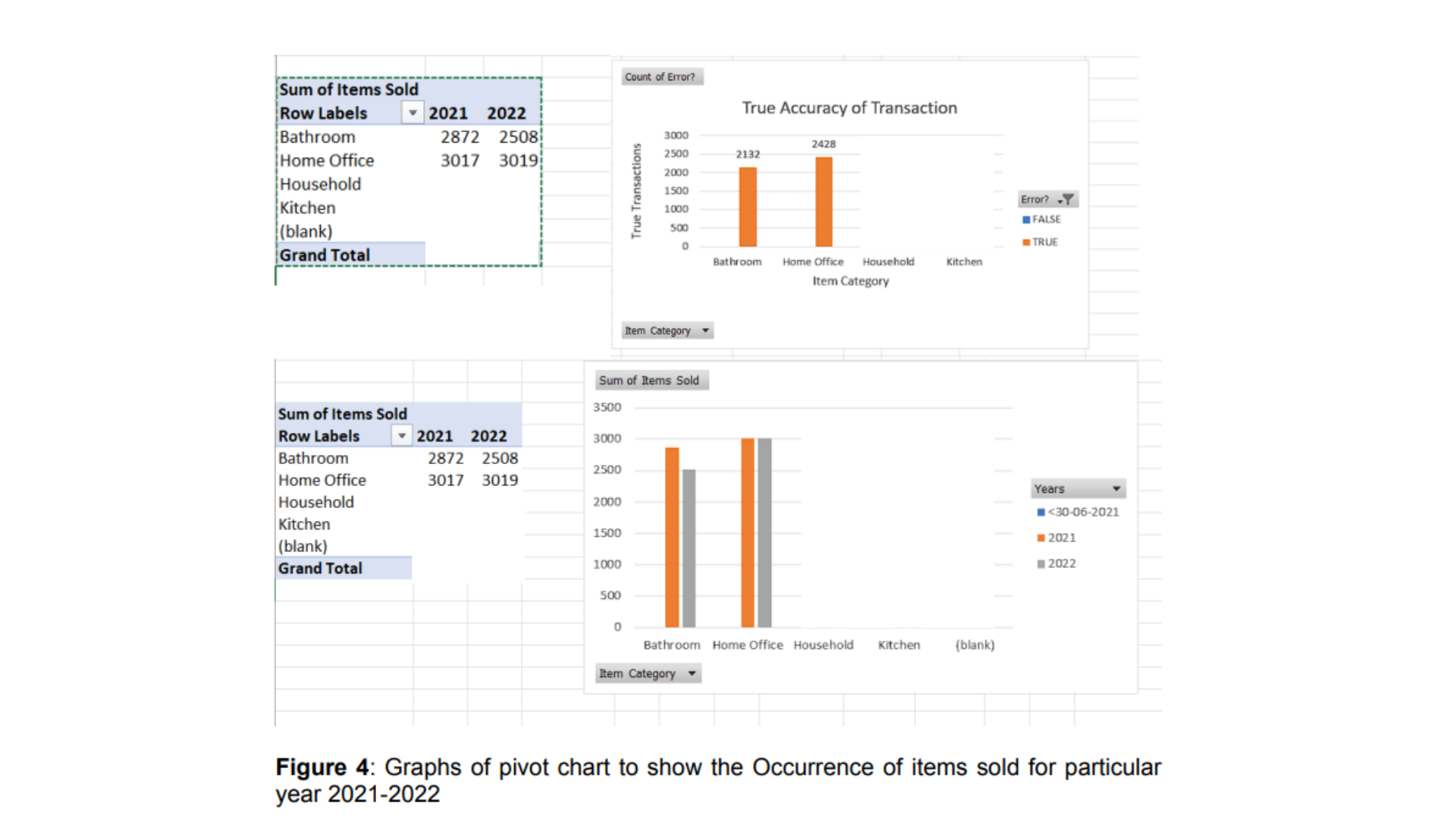

A2. Analysis of ‘Occurrence’ Assertion

Followed by assertion analysis, the auditing assignment solution discusses the occurrence assertion. OAS takes pride in delivering the best Business assignment writing services in Australia by understanding the clear requirements of the assignment and answering each section through a thorough knowledge of the subject, as well as the module learnings.

- Explanation of ‘Occurrence’ assertion as it relates to Lokka Mart

The transactions and events that have been recorded or disclosed have occurred, and such transactions and events pertain to the entity. One of the claims used by the auditor to examine data in the income statement, particularly transactions and events that have been recorded and declared actually occurred, is “occurrence,” which must be true for the period under audit.

- Visualisation of data anomaly pertaining to the ‘occurrence’ assertion

Iii. Discussion of follow-up required to further investigate ‘occurrence’

In finance, the term “occurrence assertion” relates to the confirmation that financial transactions and events actually took place and are recorded accurately in the financial statements. Excel, as a versatile tool in finance, can be employed to analyze and verify the occurrence assertion in several ways. Here’s a short explanation of how Excel can be utilized for this purpose:

- Data Filtering: Excel provides filtering capabilities that enable you to sort and filter data based on specific criteria. By filtering financial data, you can focus on specific transactions or events of interest and assess their occurrence and accuracy.

Are you also looking for Swinburne University of Technology assignment help? As it is season discount season, we are offering discounts up to 30% off. Grab your accounting assignment today! WhatsApp us at +447700174710.

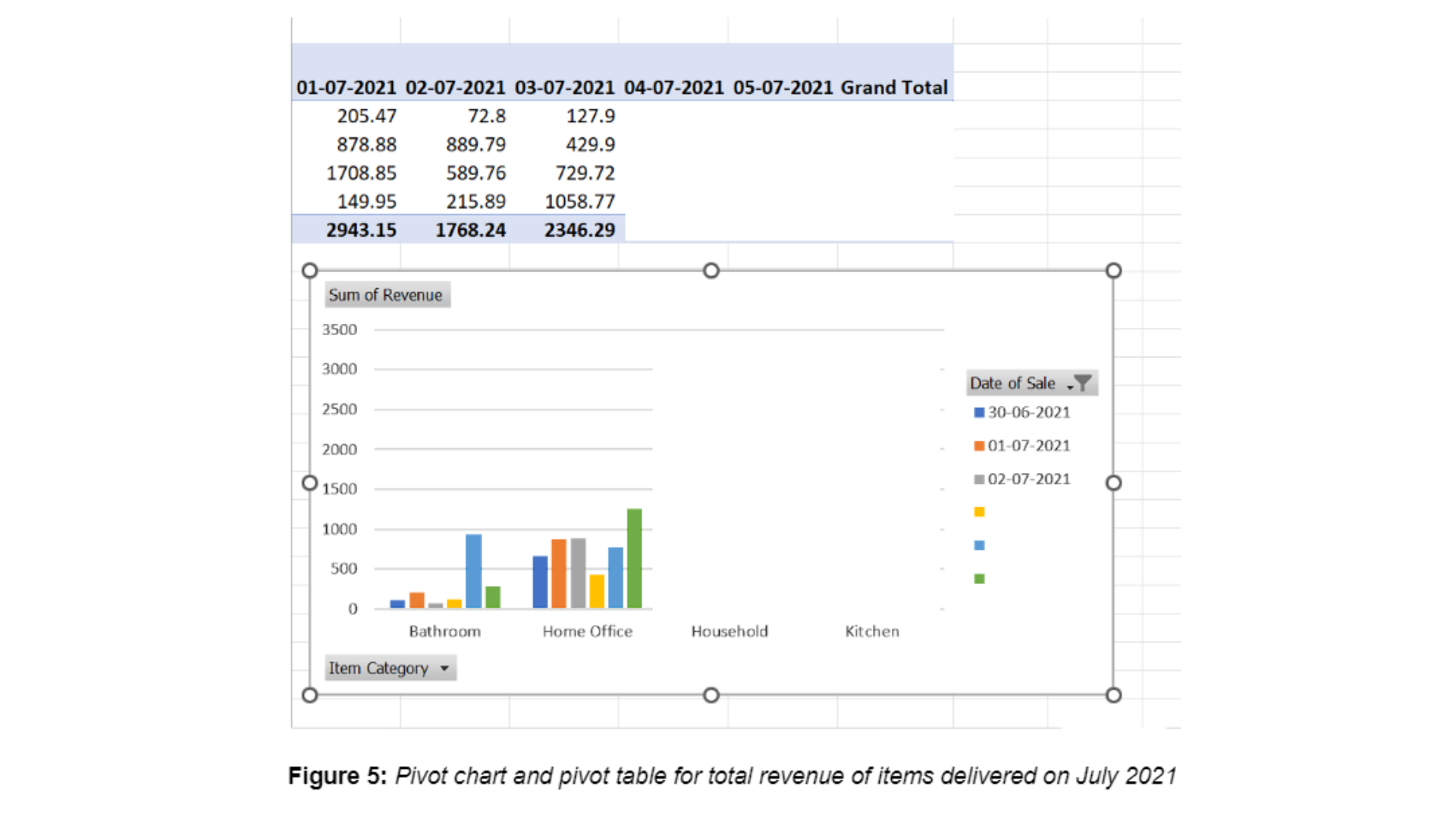

A3. Analysis of ‘Cut-Off’ Assertion

This is followed by an analysis of the ‘Cut-Off’ assertion. This assignment requires a thorough conceptual understanding of Auditing, assertion analysis, and visualization of data anomaly, which is why a lot of students require ACC30010 Auditing Assignment Help. We efficiently assist students and help them enhance their grades with expert help!

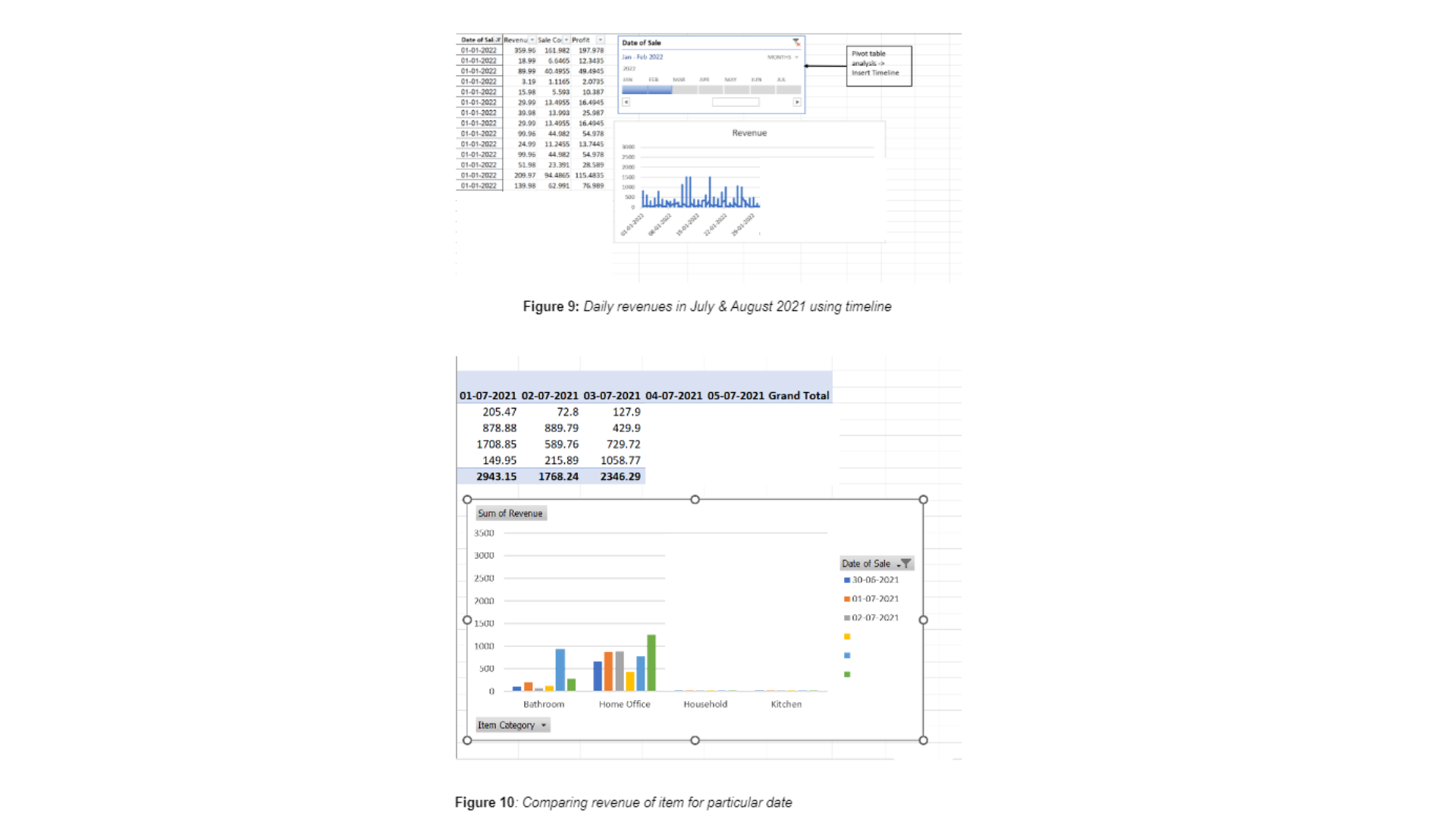

- Explanation of ‘Cut-Off’ assertion as it relates to Lokka Mart

Cut-off is the point at which all transactions and occurrences have been properly documented in the relevant accounting period. To check whether the transactions have been recorded in the correct accounting period, utilise the cut-off assertion.

The mentioned audit assertions are employed in three distinct categories.

- Transactional level claims

- ______________________________

- ______________________________

- Visualization of data anomaly pertaining to the ‘cut-off’ assertion

III. Discussion of follow-up required to further investigate ‘cut-off’

In finance, the term “cut-off assertion” refers to the accuracy and completeness of recording financial transactions within the appropriate accounting period. Excel, as a commonly used tool in finance, can be utilized to analyze and assess the cut-off assertion in various ways. Here’s a short explanation of how Excel can be employed for this purpose:

- Sorting and Filtering: Excel provides sorting and filtering features that allow you to organize financial transaction data based on dates. By sorting transactions chronologically and filtering them by the accounting period, you can examine whether all relevant transactions have been recorded within the correct time frame.

We offer the best Business assignment writing services in Australia at affordable prices! Don’t believe us? Check it out for yourself. Call us at +61 871501720.

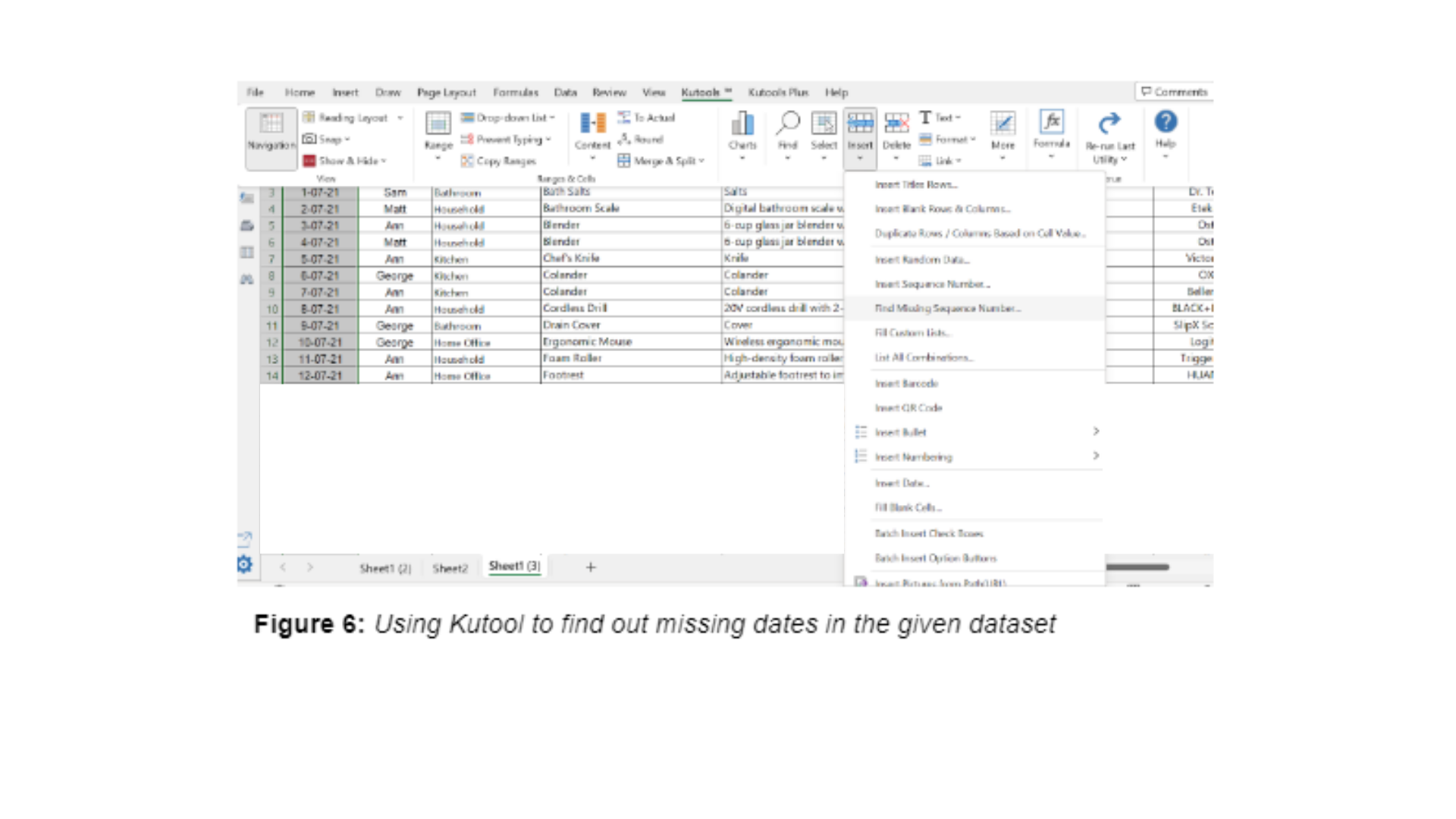

A4. Analysis of ‘Completeness’ Assertion

The last section outlines an evaluation of the completeness assertion. This section is also further divided into three sections- an explanation of the meaning of completeness assertion in association with Lokka Mart, visualization of data anomaly, and lastly a thorough discussion of the findings. You can read some parts of the complete Business accounting assignment written by our experts.

- Explanation of ‘completeness’ assertion as it relates to Lokka Mart

The fundamental meaning of the “completeness” assertion under transaction-level auditing processes is that “nothing is missing.” The claim is significant for assessing risks and so reflects Look Mark’s financial situation and business activities defined completion as “all earned income and incurred expenses that should have been recorded have been recorded.

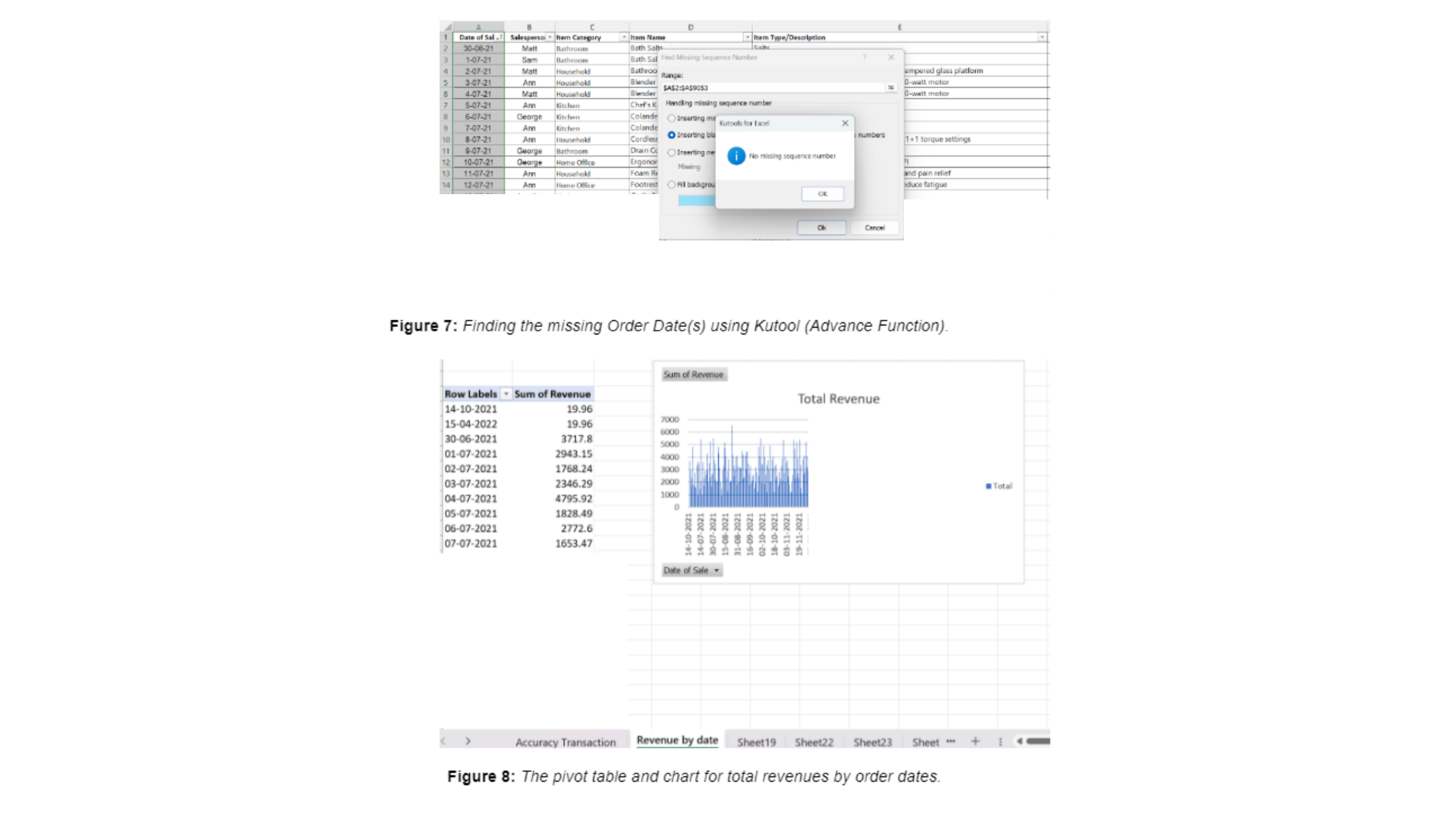

- Data Visualisation of relevant data pertaining to the ‘completeness’ assertion

iii. Discussion/Interpretation of Findings/Data Visualizations – including follow-up required (completeness assertion)

In finance, the completeness assertion refers to ensuring that all relevant financial transactions and information are recorded accurately and completely in the financial statements. Excel, being a widely used tool in finance, can be employed to analyze and assess the completeness assertion in various ways. Here’s a short explanation of how Excel can be utilized for this purpose:

- Filtering and Sorting: Excel provides filtering and sorting functionalities that allow you to organize and analyze financial data. By filtering and sorting transactions based on specific criteria, such as account codes or dates, you can identify any missing or incomplete records and assess the completeness of the data set.

Completeness enables auditors to verify that every transaction for the review period has been appropriately placed in the proper time period. An auditor would wish to review payroll records to make sure that all salaries and wage expenses, for instance, have been recorded at the relevant timeframe.

Want ACC30010 Auditing Assignment Help? Mail us at onlineassignmentservices1@gmail.com and get exciting discounts of up to 30% off!