ACCT6004: Finance Case Study Assignment Help

Question

ACCT6004: This Southern Cross University assignment is a case-study-based assessment where the students are required to provide an analysis of the risks, returns, and data of the project for the Board of Directors of Lock Limited Australia. The students are also supposed to provide a spreadsheet to support their results and reasoning with appropriate data. In addition to the analysis of risks and returns for the company, the assignment also demands the student to propose certain recommendations based on the project evaluation.

Solution

The case scenario presented for analysis is based on Lock Limited, a hypothetical Australia-based hardware company. Pertaining to the pressure of performance improvement from shareholders, the Board of Directors has demanded an analysis of the risk and return for the company, project evaluation, and certain suggestions based on these calculations for the company. The assignment file also provides the company’s share price and dividend history, as well as market index history to give students an idea about the company’s financial situation.

The solution incorporates two parts- a document file that provides a detailed analysis of the risk, and returns for the organization while comparing it to the market condition. Additionally, a spreadsheet is also provided supporting all the findings through numbers and figures.

Document

The document constitutes two sections, for which we have provided a snippet of the complete answers written by our experts.

Assessment of Risk & Return

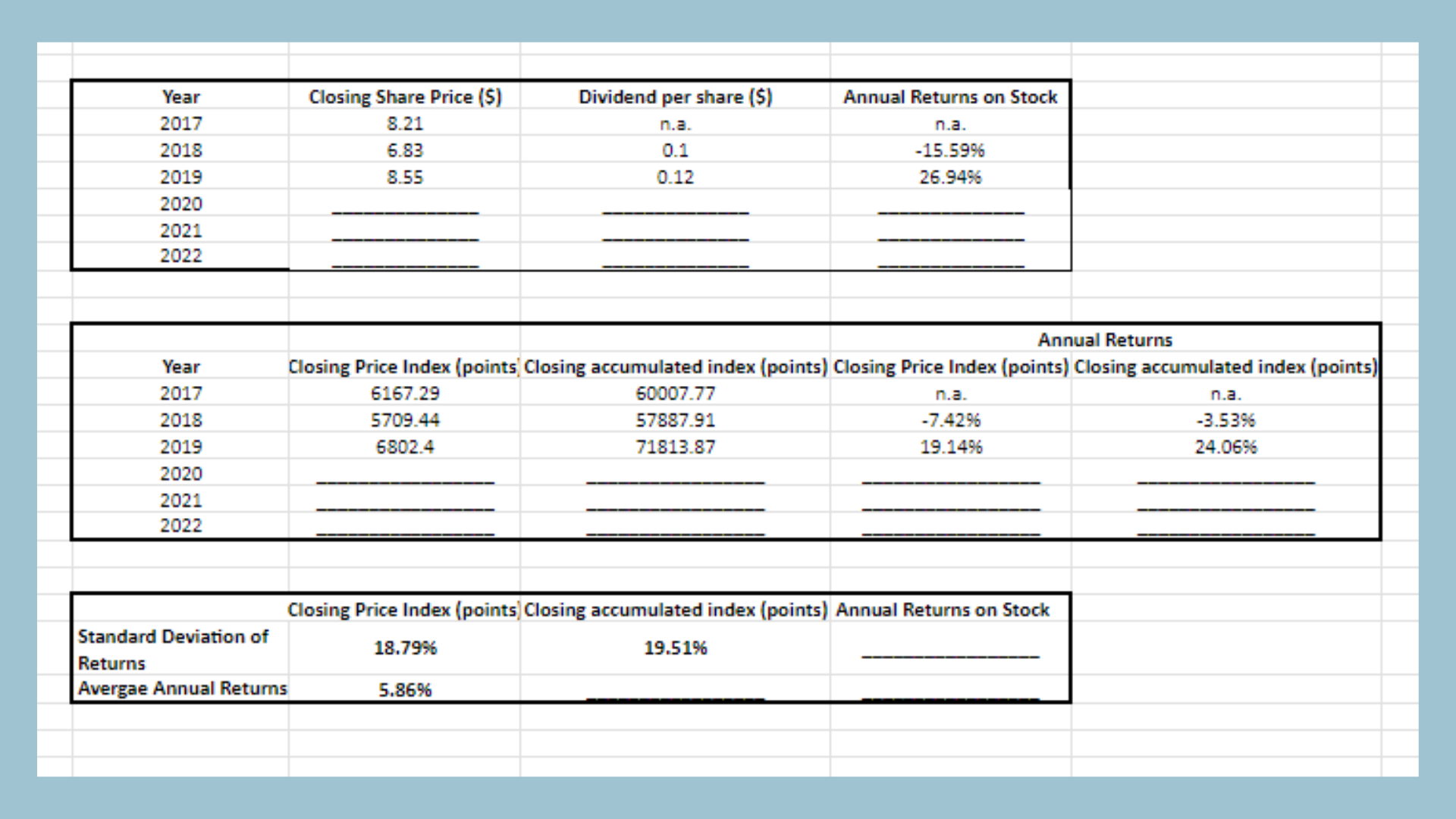

Firstly, our experts have engaged extensively with the data provided to us in the case scenario for Lock Limited to assess the risks and returns of the company based on a comparison to the market index. Appropriate and relevant measures are used by our experts to analyze the two aspects.

The objective is to compare the risk and returns of the hypothetical Lock Limited stock with that of the market index. In order to compare the risk, the standard deviation of returns would be used as the suitable measure. For comparing the returns, the average annual return has been computed for the given stock and also the market index. The average returns and standard deviation for the Lock Limited stock and the two indices are summarised in Appendix 1. The average annual returns on the Lock Limited stock during the period 2018-2022 is 5.70% p.a. The closing accumulated index during the same period has an average return of 7.79% p.a. With regards to standard deviation of mean returns, the corresponding value for Lock Limited stock based on the annual returns during 2018-2022 is 16.75% as compared to 12.50% for the accumulated price index. Modern portfolio theory indicates that risk and return are related. Rational investors want to maximise their returns and minimise the underlying risk. As a result, there is always a trade-off between risk and return.

Looking for Finance Case Study Assignment Help Australia? Please WhatsApp us at +447956859420 to know more.

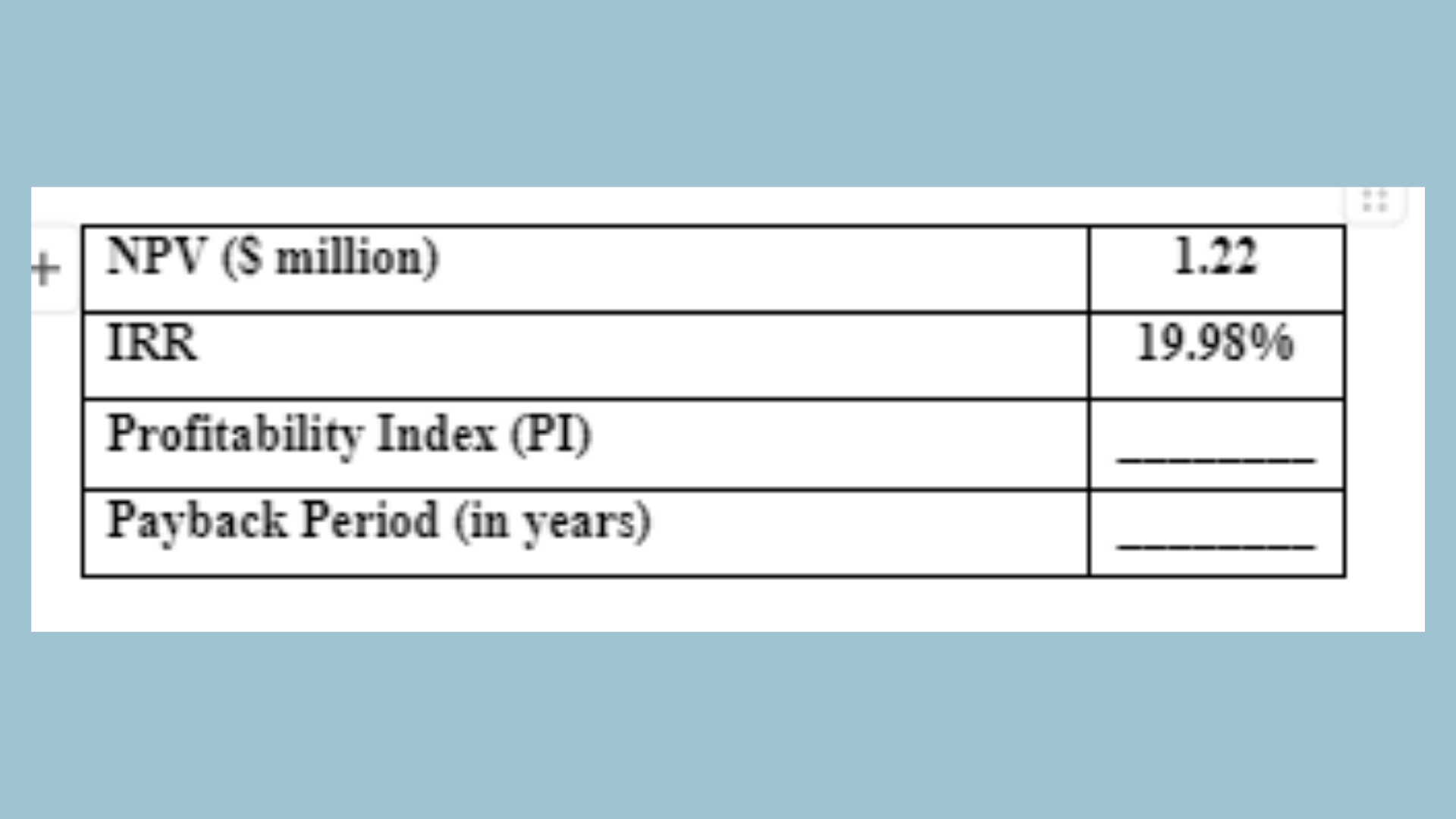

Project evaluation and recommendation

In this Finance Case Study Help assignment help, our experts have proposed certain recommendations for the project based on its evaluation of the risks and returns. You can read some of these recommendations below.

The objective of this report is to analyse the project and provide suitable recommendations to the board of directors. The incremental cash flows for the manufacturing in-house on the basis of new window lock design project have been highlighted in Appendix 2. Some assumptions used in determining it are as follows.

1) The capital gains realised on the sale of equipment at the end of five years is the same as tax rate applicable on income i.e. 30%.

2) ___________________________________________ __________________________________________________________________________________________

The amount of $500,000 which has been spent on the development of the new window design is sunk cost and hence not considered in the incremental cash flow analysis. It is a sunk cost since irrespective of the decision to pursue or not pursue the project, this cost cannot be recovered by the company (Brealey, Myers & Allen, 2017). The incremental cash flows analysis is based on the potential cash inflows and cash outflows as the company changes from licensing to manufacturing. If the company would have licensed, then it would have derived an annual licensing fee of $1 million. If the company decides to manufacture on its own, then it would have to forego this licensing fee and hence it is taken as an opportunity cost in the incremental cash flow analysis. However, the company would save $200,000 it would have spent on the legal and administrative cost related to the licensing. Since the licensing contract would have extended to several years, hence the associated legal cost has been taken as a capital expenditure (Petty et. al., 2016). Another opportunity cost which is relevant to incremental cash flow analysis is the lost rental revenue from the factory which Lock has currently rented to other business. If the company does go ahead with manufacturing, then this factory would be used and thus the rental revenue of $300,000 annually would be lost.

We provide the best-quality Finance Case Study assignment help to elevate our students’ assignments and help them achieve excellent grades. If you also need help with your Finance Case Study assignment, please call us at +61 871501720.

Spreadsheet

Our experts have also developed a spreadsheet to justify the findings of the document. The solution written by our experts demonstrates the financial analysis of the risks and returns of the company to the market indexes.

We observed you were looking for Finance Case Study Assignment Help. Look no more, reach out to us at onlineassignmentservices1@gmail.com.