GSBS6385: Investment Decision Written Assignment Help

Question

GSBS6385: This Investment Decision written assignment corresponds to the Financial Management and Decision-making in Healthcare (GSBS6385) for the University of Newcastle Australia. The task file incorporates two investment decision-related questions, which the student is required to answer through the use of proper capital budgeting analytical tools used for the healthcare industry. A spreadsheet needs to be developed by the student which should highlight all the important calculations along with their appropriate reasonings.

Solution

Our experts have prepared the spreadsheet using in-depth research and their expertise in the subject. The solution is divided into two scenario-based questions which further include sub-questions, a part of which you can read below:

Context for Question 1

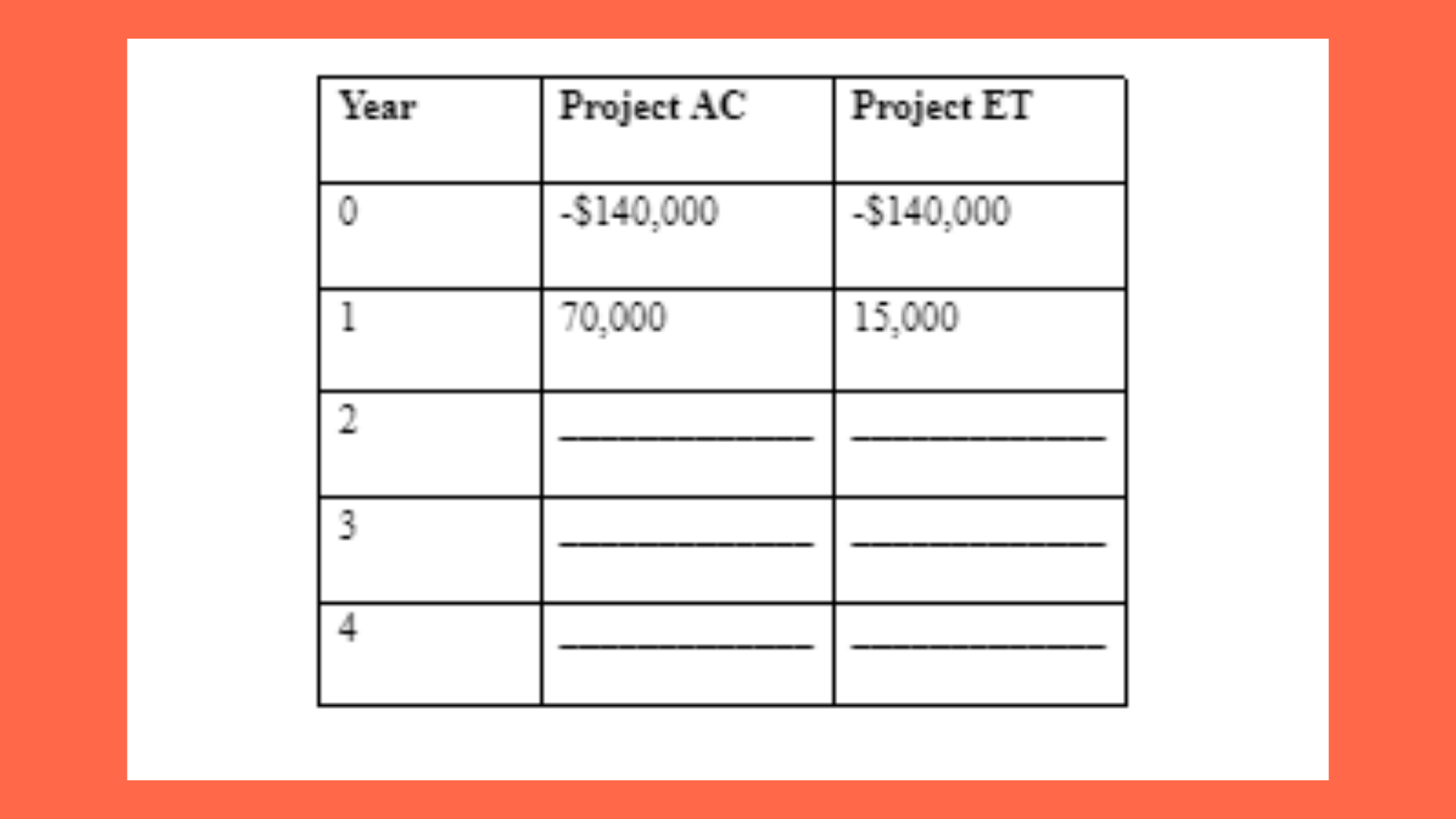

In the first question, the student is required to imagine themselves in the role of a CFO working for a private healthcare service provider. It is remarked that two opportunities have been identified to provide healthcare-related services to two distinct third-party service providers concerning other possible therapies within a life cycle that lasts for four years. Acupuncture and Electromagnetic Therapy are the two alternative therapies. It is suggested that as the capital is limited, the CFO would be able to choose only one of the two therapies. Based on this scenario, the student is supposed to answer the following questions:

Part a

The first sub-question for question 1 urges the student to accurately determine the IRR for both Acupuncture and Electromagnetic Therapy. Based on these calculations, it is also highlighted which projects are more appropriate according to IRR.

IRR may be defined as the discount rate for which the project NPV becomes zero. The project cash flows are highlighted below.

Since the above projects are mutually exclusive, hence based on IRR project, ____________________________________________________________________________________________________________________________

Looking for Investment Decision assignment help answers? We are here to help! Mail us at onlineassignmentservices1@gmail.com.

Part b

This next question demands the student to provide the NPV for the two projects by assuming that the rate of return which is required is 10%. Our experts have also ensured that this answer upholds the first sub-section answered above.

Required rate of return = 10% p.a.

The NPV for each of the projects has been computed using Excel.

NPV for Project AC = _____________

NPV for Project ET = ______________

Since the NPV (ET) > NPV (AC), hence,_______________________________________________________________________________________________________________________

This is only 50% of the solution. To know more, WhatsApp us at +447956859420.

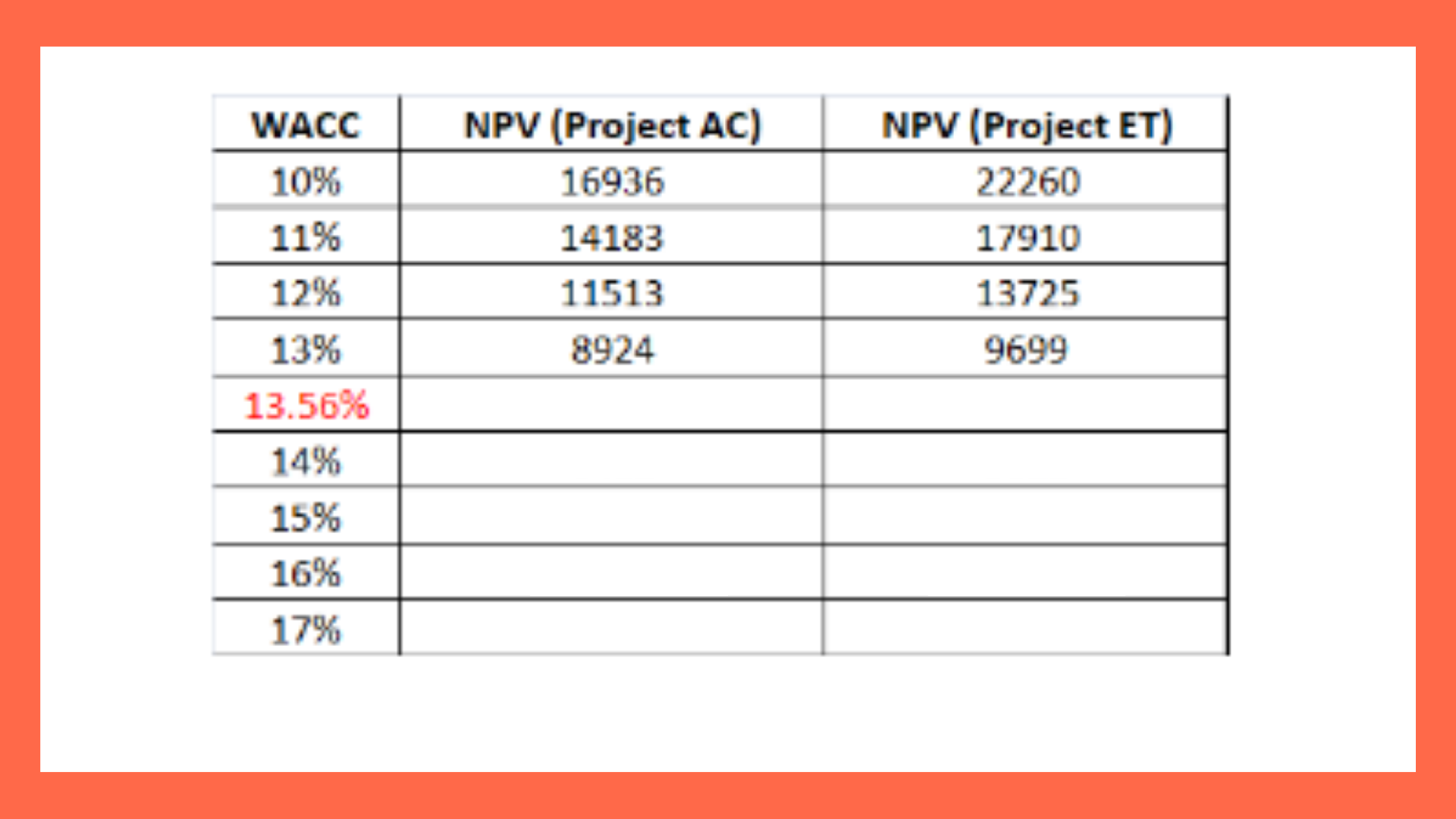

Part c

In this section, the rate of return needs to be identified for which Project Acupuncture becomes more appropriate than Electromagnetic Therapy. In addition to this, the rate of return for which both the therapies become equal in terms of their chance of getting implemented is also determined.

The required rate at which one would be indifferent between the two projects would be where the NPV for each of the projects would be the same. This has been computed through Excel and came out as 13.561%.

Want to read the complete table? Reach out today- onlineassignmentservices1@gmail.com.

Part d

This is the last sub-question for the first context. In this question, our experts have highlighted what would have happened if the two projects were of unequal lives and whether it would have been possible to compare them then.

Even if the projects had unequal lives, still they could have been compared. In order to do that, ____________________________________________________________________________________________________________________________

Searching for Investment Decision Written Assignment Help Australia, no need to worry. Just give us a call at +61 871501720.

Context for Question 2

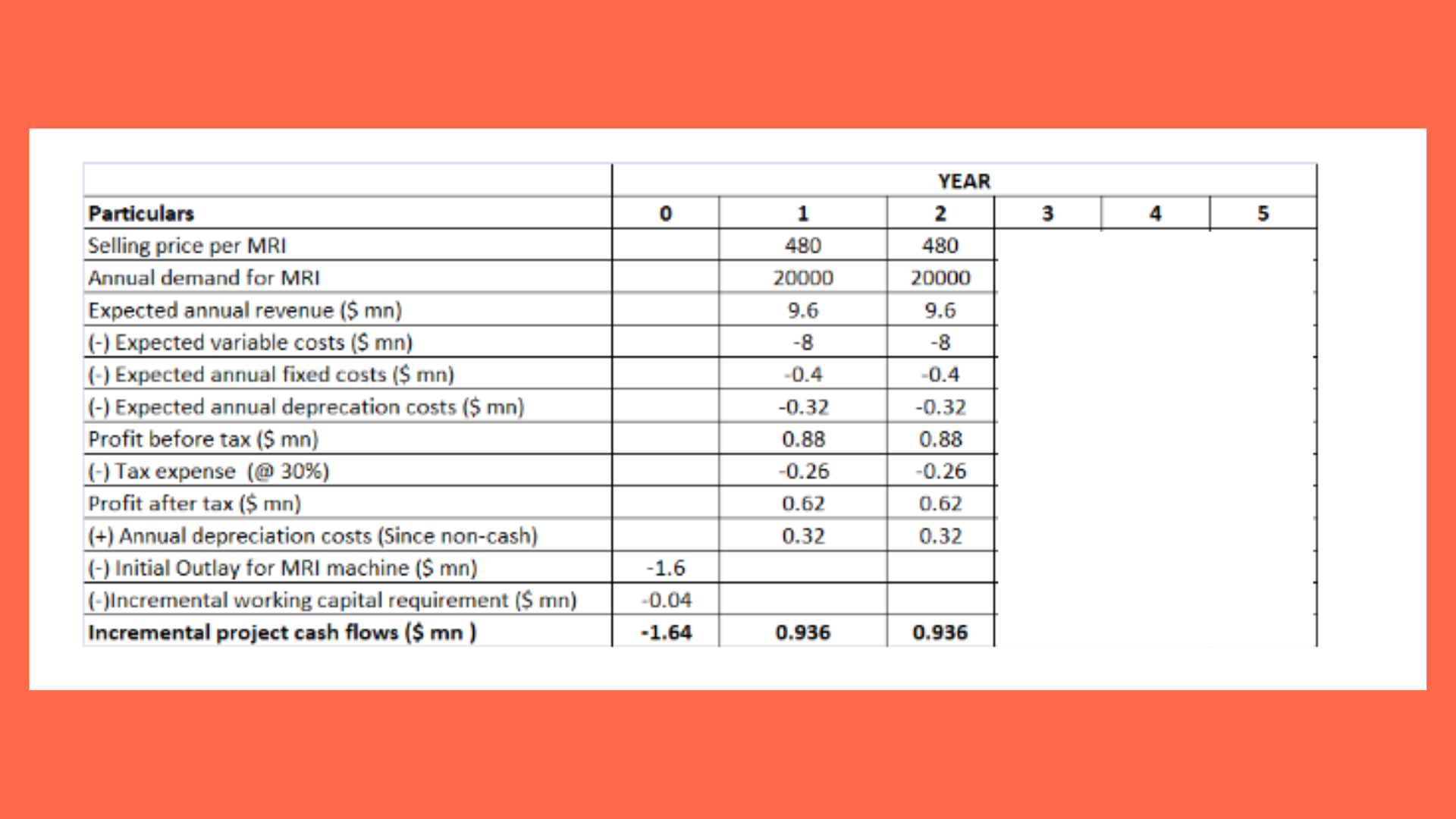

The second context revolves around the consideration of a new MRI machine to be introduced in a private hospital in which the students imagine themselves to be working. Various costs and investments needed to be related to the installation are provided to the student, based on which the student is supposed to answer the questions that follow.

Part a

The first question highlights the feasibility of the project based on the NPV. The calculations done by our experts are accurate and provide clear justifications.

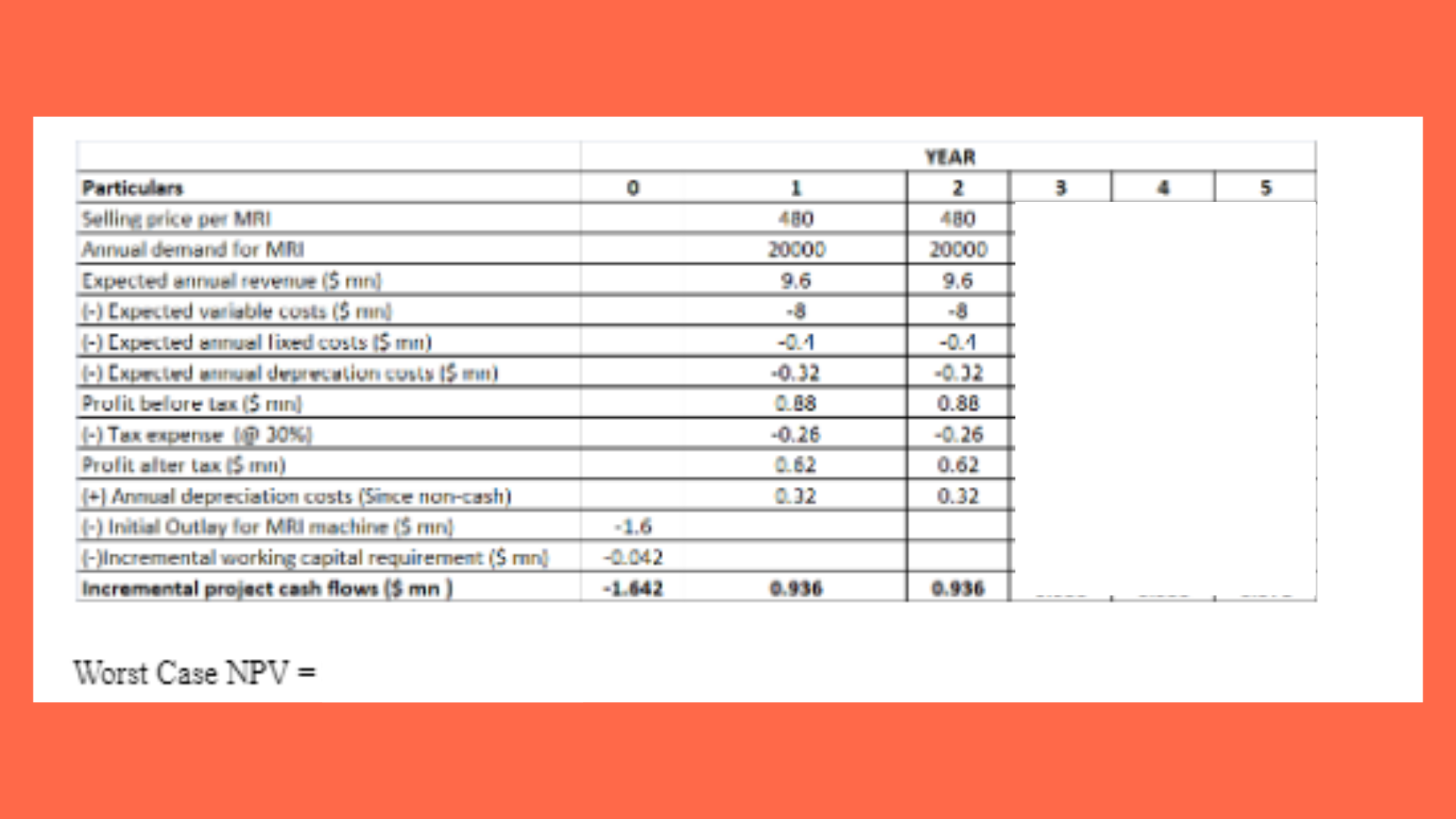

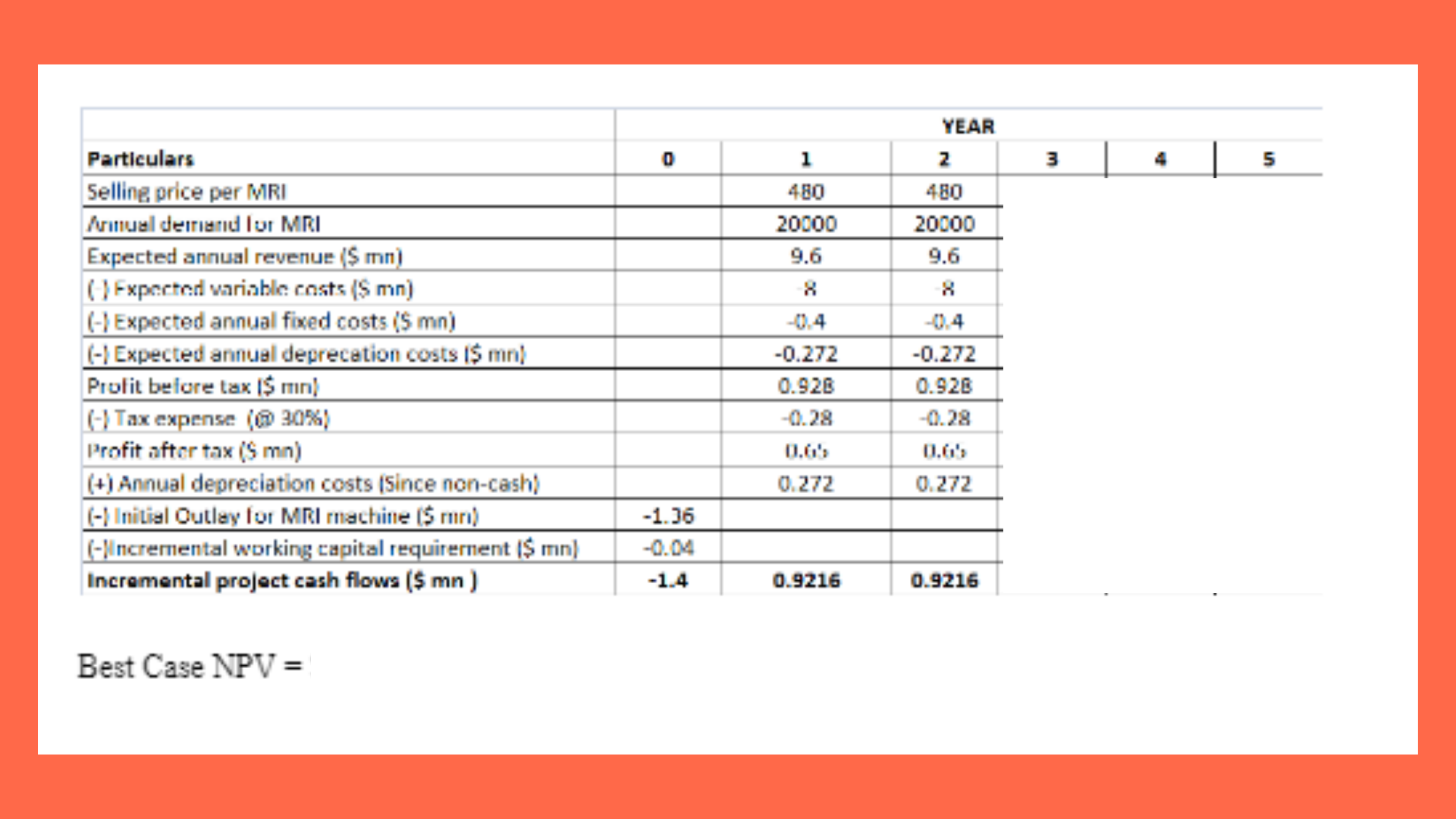

The incremental cash flows with regard to the MRI project are summarised in the table below.

Explanation

- Expected annual revenue = Selling price per MRI * Annual demand for MRI

- Expected variable cost = ________________________________

- Expected annual depreciation costs = (Cost of MRI machine – Salvage Value)/Useful life = ________________________________= ________________________________

- Profit after tax = Profit before tax – Tax expense

- __________________________________________________________________________________________________________________

- __________________________________________________________________________________________________________________

Required rate of return = _____________

NPV = _______________ (Using Excel)

Since the NPV for the MRI machine project is positive, hence one should ______________________________________________________________

Confused about whether the project is good to go or not? Reach out today- onlineassignmentservices1@gmail.com.

Part b

The following question demands a sensitivity analysis to be done by the student. Certain conditions are given in the question which include the net working capital estimate to be -+5%, estimated selling price around -+10%, and cost of initial equipment within -+15% accuracy. Based on this, our experts have identified the best-case and worst-case NPV. Additionally, it is also suggested if the project is feasible to be accepted or not.

The sensitivity analysis for the project is performed as shown below.

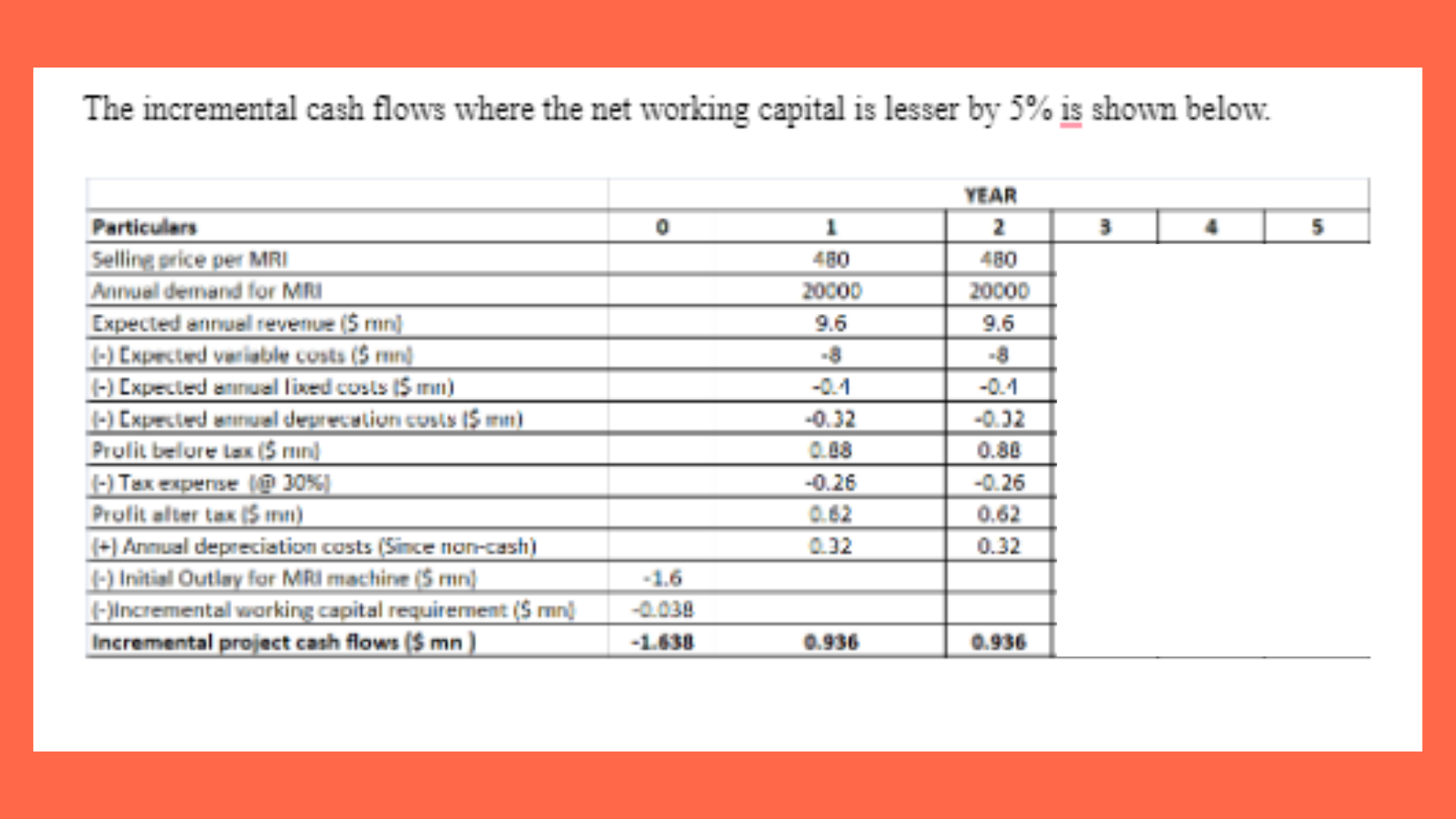

Net working capital (+/- 5%)

The incremental cash flows where the net working capital exceeds by 5% is shown below.

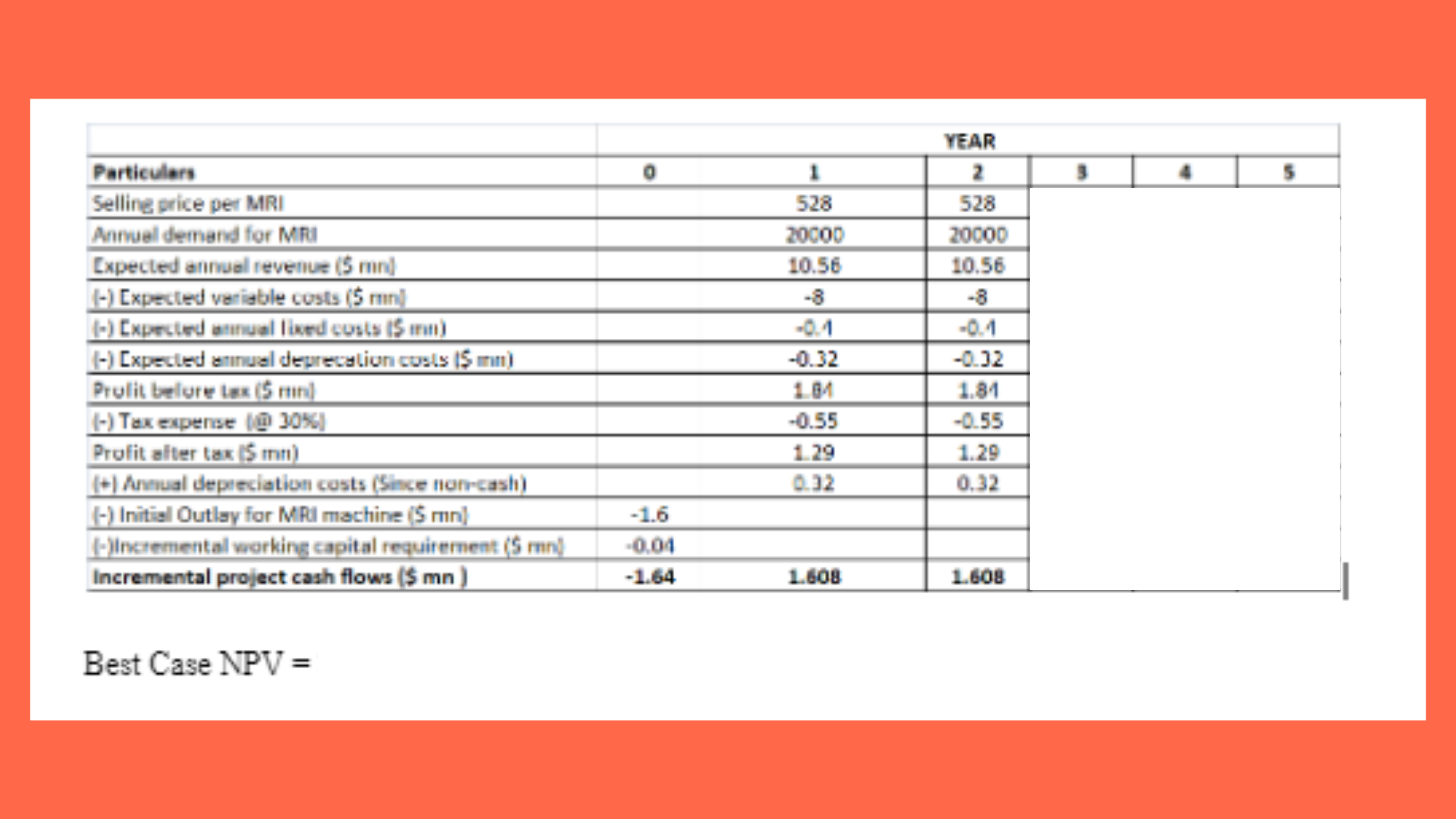

Best Case NPV = ________________________

Selling Price (+/- 10%)

The incremental cash flows where the selling price increases by 10% is shown below.

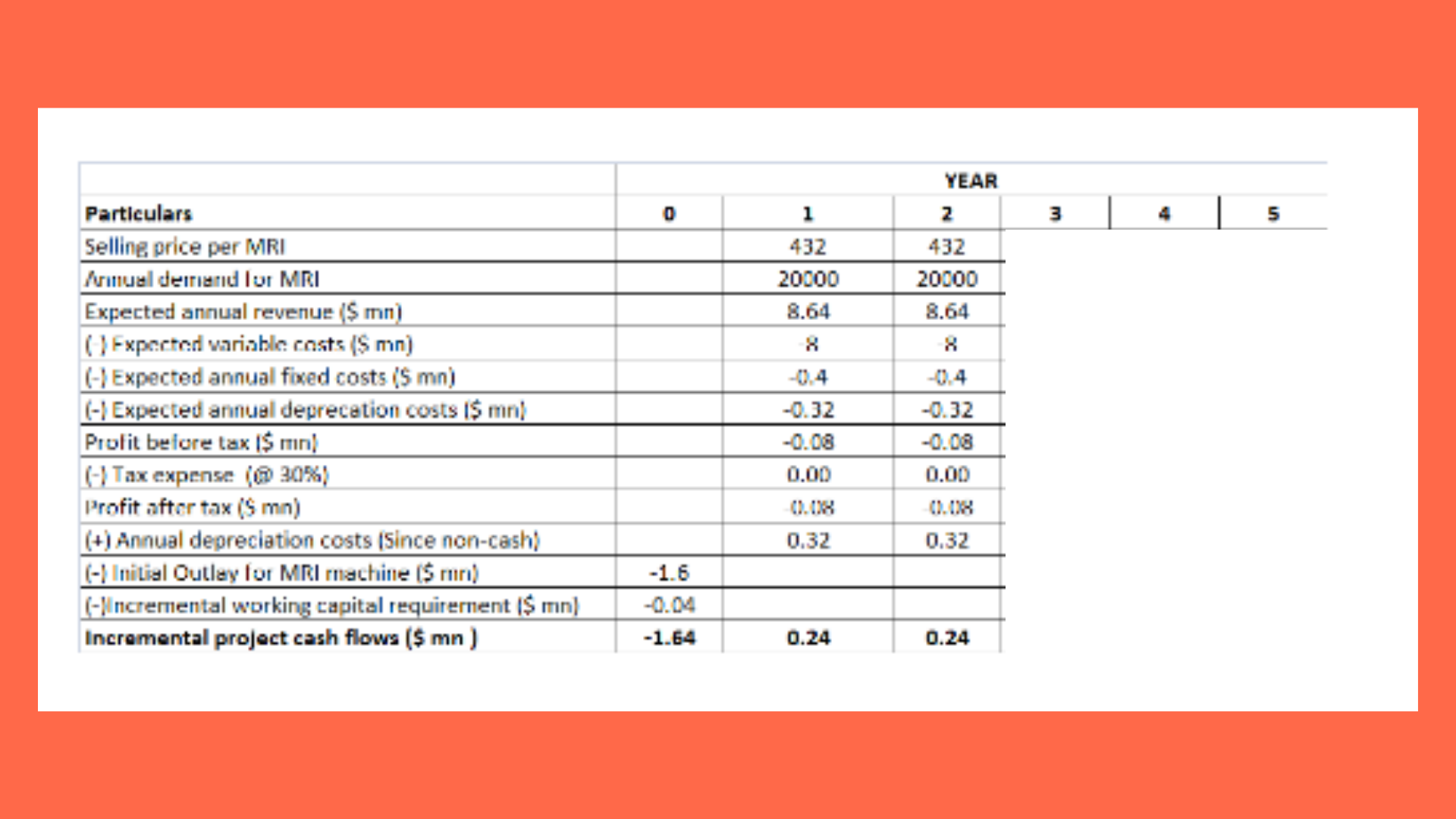

The incremental cash flows where the selling price decreases by 10% is shown below.

Worst Case NPV = -_________________

The NPV of the project is clearly highly sensitive to the selling price and if the realised price is 10% lower than the base price of $480, then ____________________________________________________________________________________________________________________________

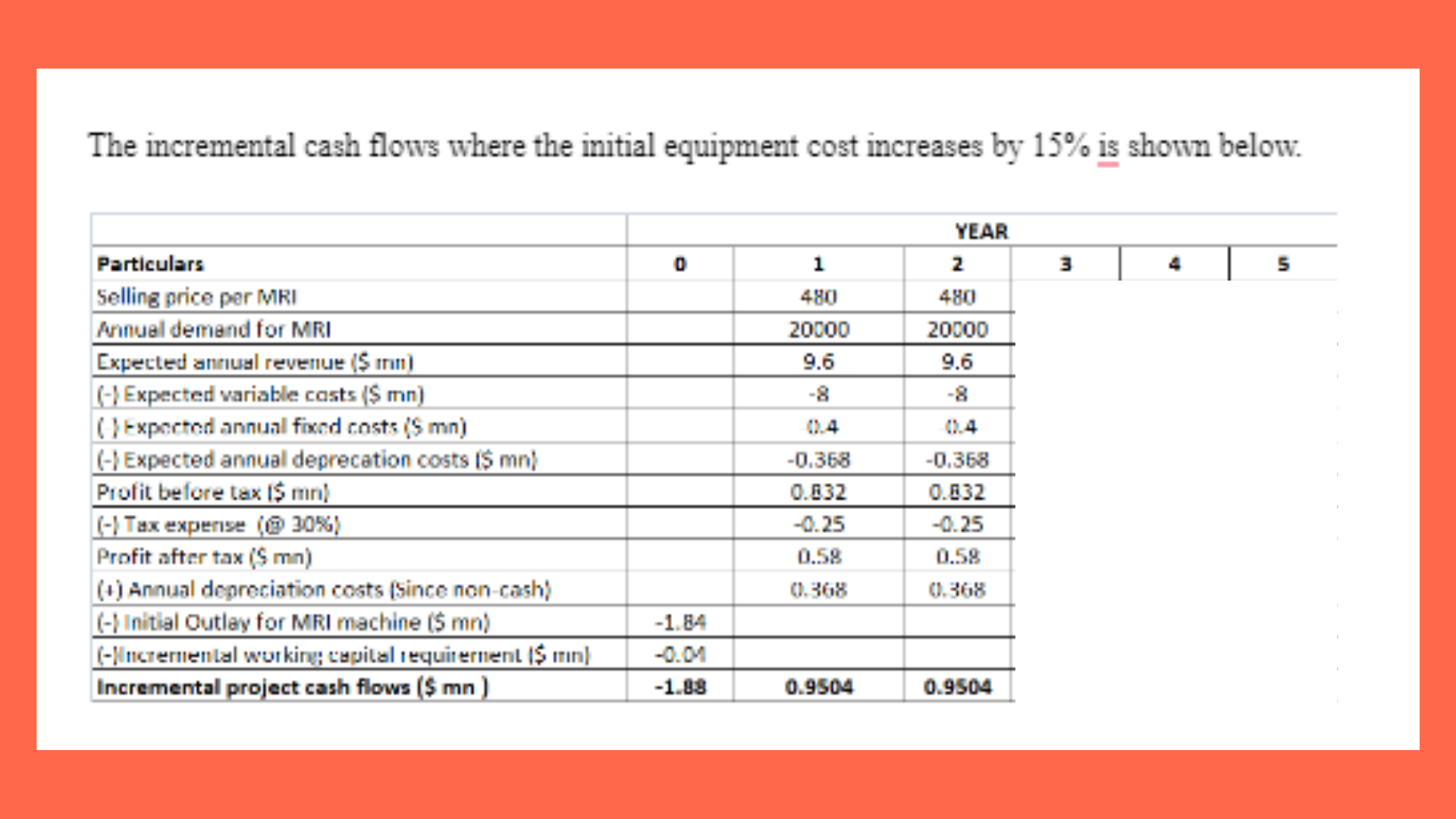

Initial Equipment Cost (+/-15%)

The incremental cash flows where the initial equipment cost decreases by 15% is shown below.

Worst Case NPV = __________________

Based on the above computations, it is evident that the worst case NPV also remains significantly positive. Thus, ____________________________________________________________________________________________________________________________

Conclusion

The project would still be accepted since only when the selling price varies unfavourably by 10% is the NPV negative. In all the other variations, NPV remains positive and thereby the project remains feasible.

This is only a snippet of the complete answer written by our expert. Call us at +61871501720 to read more.

Part c

This section provides a critical appraisal of capital cost and the significance of its consideration in profit as well as non-profit sectors. Our experts have supported this answer with data from previous calculations.

An important aspect with regards to project feasibility is the cost of capital. It is essentially the cost associated with the capital arranged for a given project. Typically cost of capital is a function of the underlying risk of the project. Projects having a higher risk tend to have a higher cost of capital while relatively safer projects have lower cost of capital. The cost of capital also depends on the capital structure used to fund the project. Typically cost of capital is also knows as Weighted average cost of capital or WACC since it depends on the underlying weights of various funding sources and their respective costs. For a profit-making enterprise, determining the cost of capital is relatively easier as compared to determining for a no profit-making enterprise.

Did you like the assignment written by our experts? Let us help you as well. Reach out today- onlineassignmentservices1@gmail.com.