ACCT5002: Accounting for Managers Assignment Help

Question

ACCT5002: This Southern Cross University assignment is a continuation of assessment 1 for the course Accounting for Managers. In this assignment, the students are required to write a financial review assignment for the company chosen in Assessment 1. The students are required to study the company’s annual financial reports along with other information on the organization and analyze this financial data in detail. This financial review should be context-related and developed in light of the company’s general background.

Solution

The company chosen for financial review is Adairs Limited, for which financial reports were provided to the student.

The solution is divided into three sections: Part A- Analysis of Financial Health through the Cash Flow Health Dimension, Part B- Analysis of Financial Health through Other Dimensions, and Part C– an overall Evaluation of Financial Health.

Part A- Analysis of Financial Health through Cash Flow Health Dimension

In the first section, the financial statements for Adairs Limited are evaluated based on its cash flows. A comparison is made between the cash flows for the present year and the previous year by our experts as well.

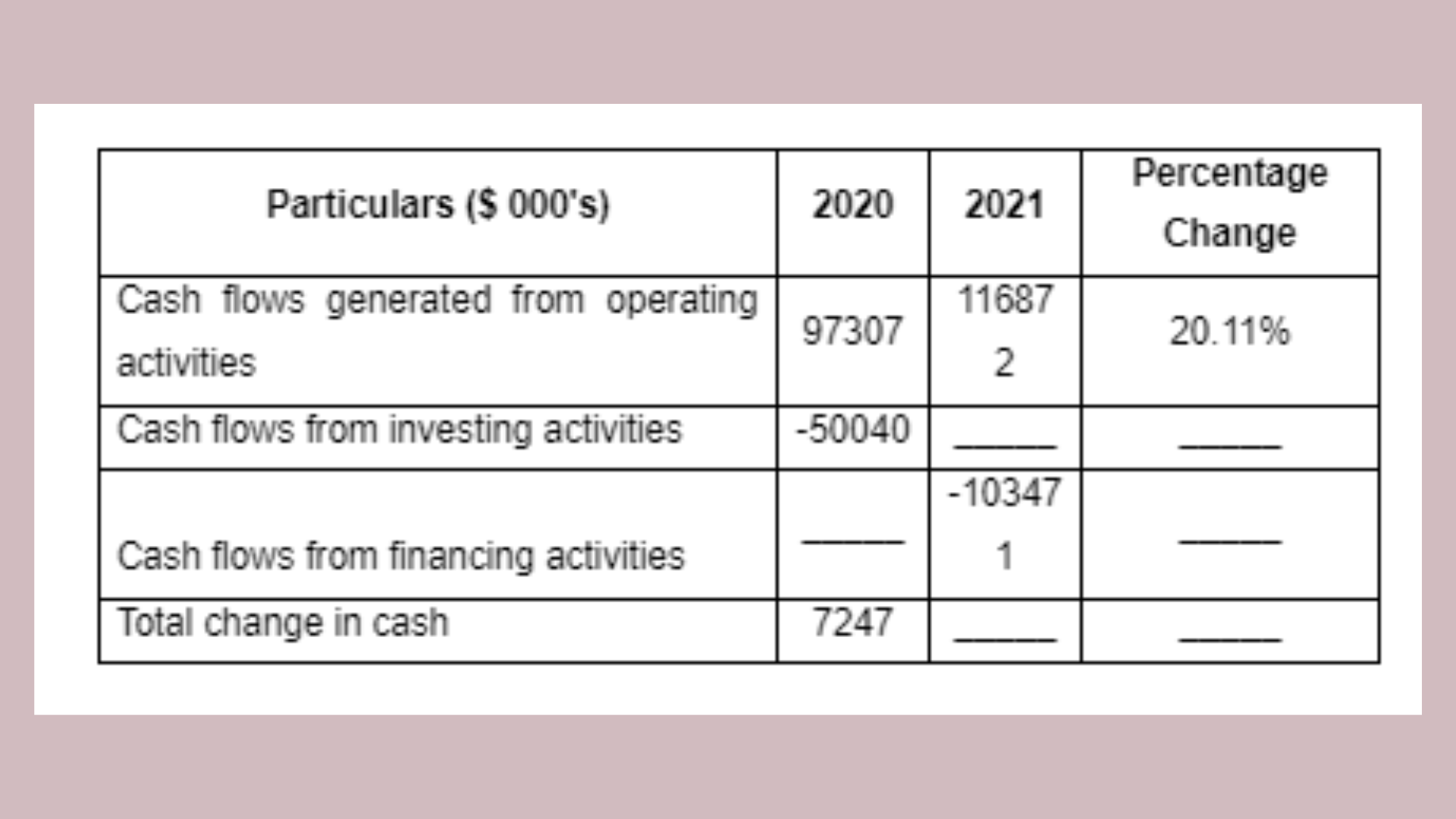

The changes in the key components of the cash flow statement for Adairs Limited has been summarised in the table below (Adairs, 2021).

The cash flows generated from operating activities has increased by 20.11% in 2021 when compared to 2020. This is primarily attributed to the improved operating performance including robust sales growth along with expansion of profit margins. The company as a result also returned grants from the government under JOBKEEPER program to the tune of $6.077 million in 2021.

Want complete calculations? Don’t hesitate to WhatsApp us at +447700174710.

Part B- Analysis of Financial Health: Other Dimensions

The second part of the solution constitutes a financial health analysis based on different dimensions including profitability, efficiency, liquidity, financial gearing, and investment performance for the organization. Our experts have used evidence from annual reports as well as press coverage related to the financial information about the company.

The ratio analysis of the financial statements for Adairs Limited from 2019 to 2021 has been carried in this section.

Profitability

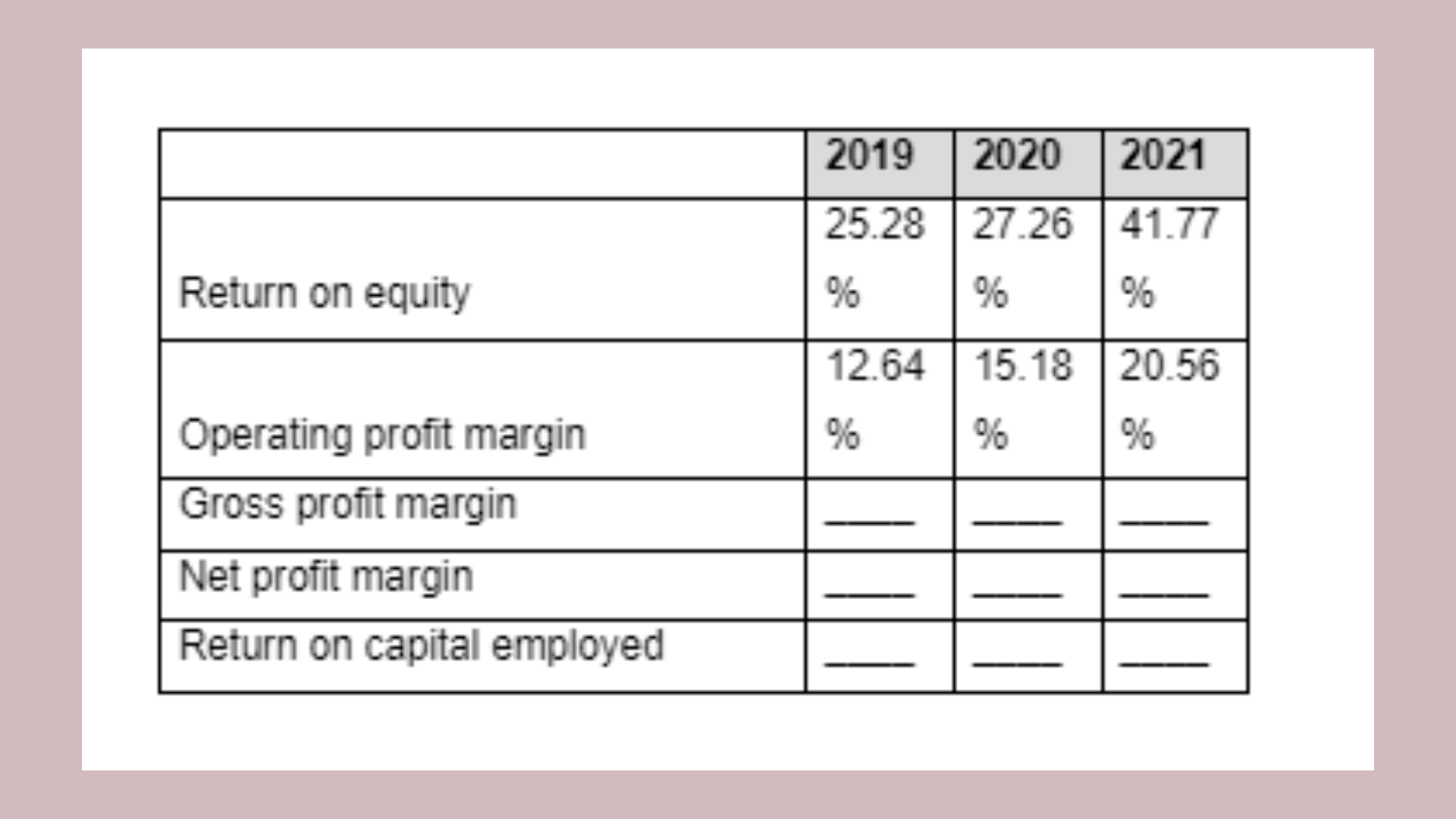

The relevant profitability ratios for 2019-2021 have been summarised in the table below.

The various profitability ratios highlighted above indicate that the profitability of the company has been improving during 2019 to 2021. The gross profit margins despite staying constant in 2020 have registered an improvement of 358bps in 2021. This may be attributed to robust customer demand owing to which there were 44 less days of promotional prices being given to customers. Another reason contributing to increased gross margins during 2021 was the program comprising of retail price initiatives and sourcing initiatives run by the company (Adairs, 2021).

Efficiency

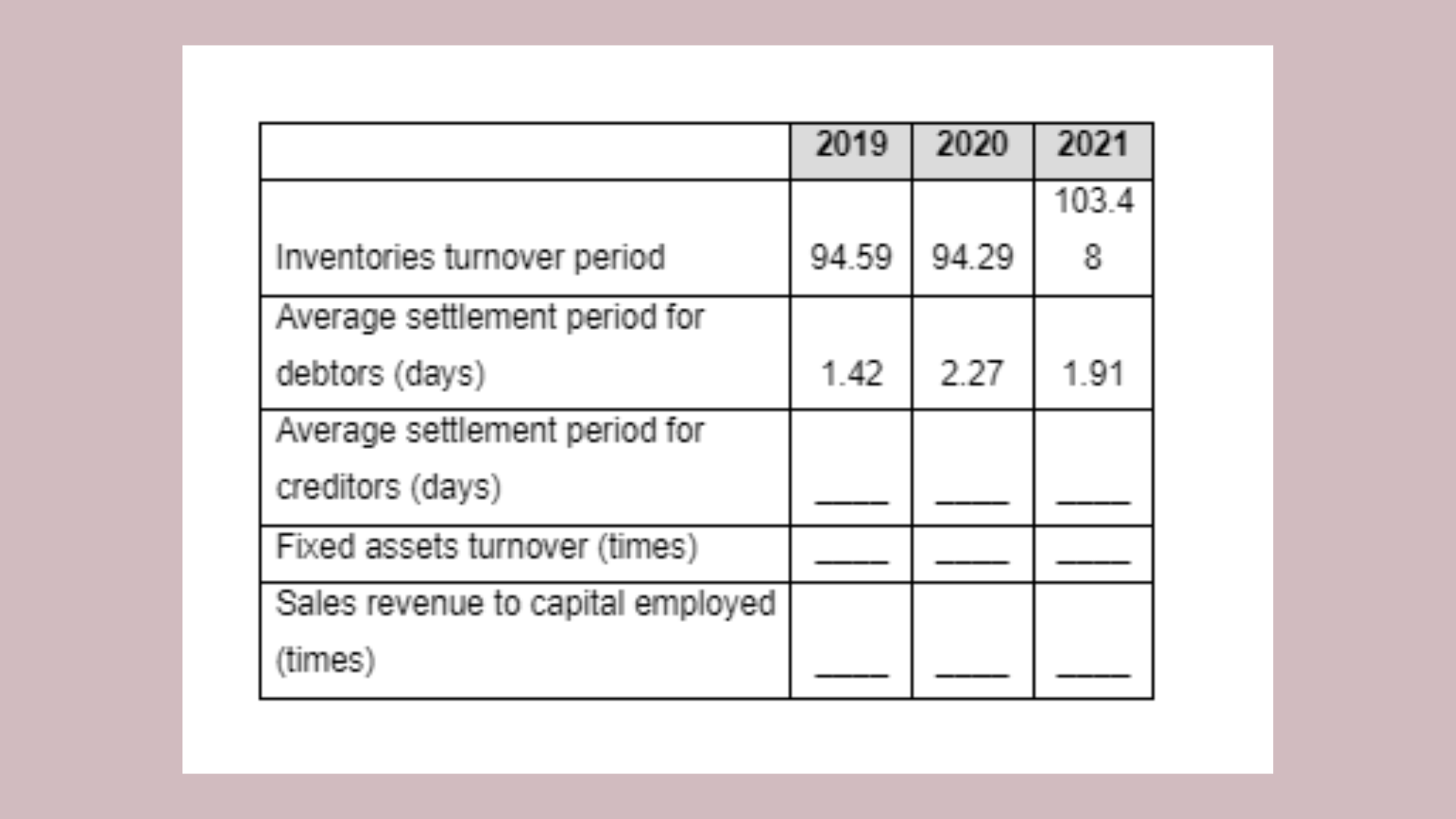

The relevant efficiency ratios for 2019-2021 have been summarised in the table below.

The inventories turnover period has remained almost same during 2019-2020 but has deteriorated slightly during 2021. This indicates that the company took more days to convert inventory into sales in 2021. The average settlement period for debtors has shown significant improvement in 2021 as compared to 2020. This may be attributed to robust customer demand owing to which lower credit period on average was given by the company. This augers well for the company as it would help in reducing the overall cash cycle and the extent of working capital finance required.

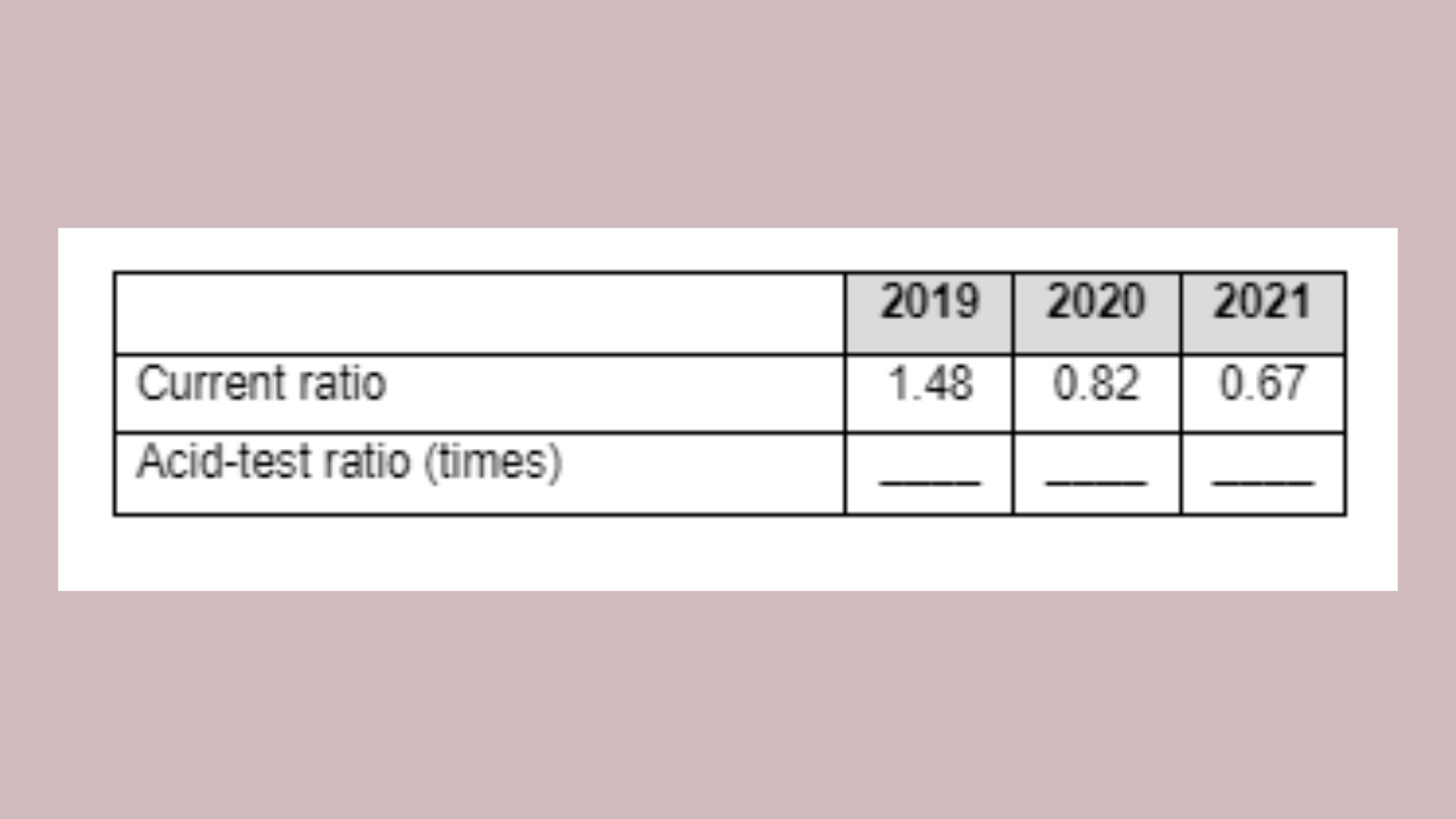

Liquidity

The relevant liquidity ratios for 2019-2021 have been summarised in the table below.

The liquidity ratios highlighted above indicate the ability of the company to meet the short term obligations i.e. current liabilities. The current ratio of the firm has significantly declined from 2019 to 2021 since it has dropped from 1.48 to 0.67.

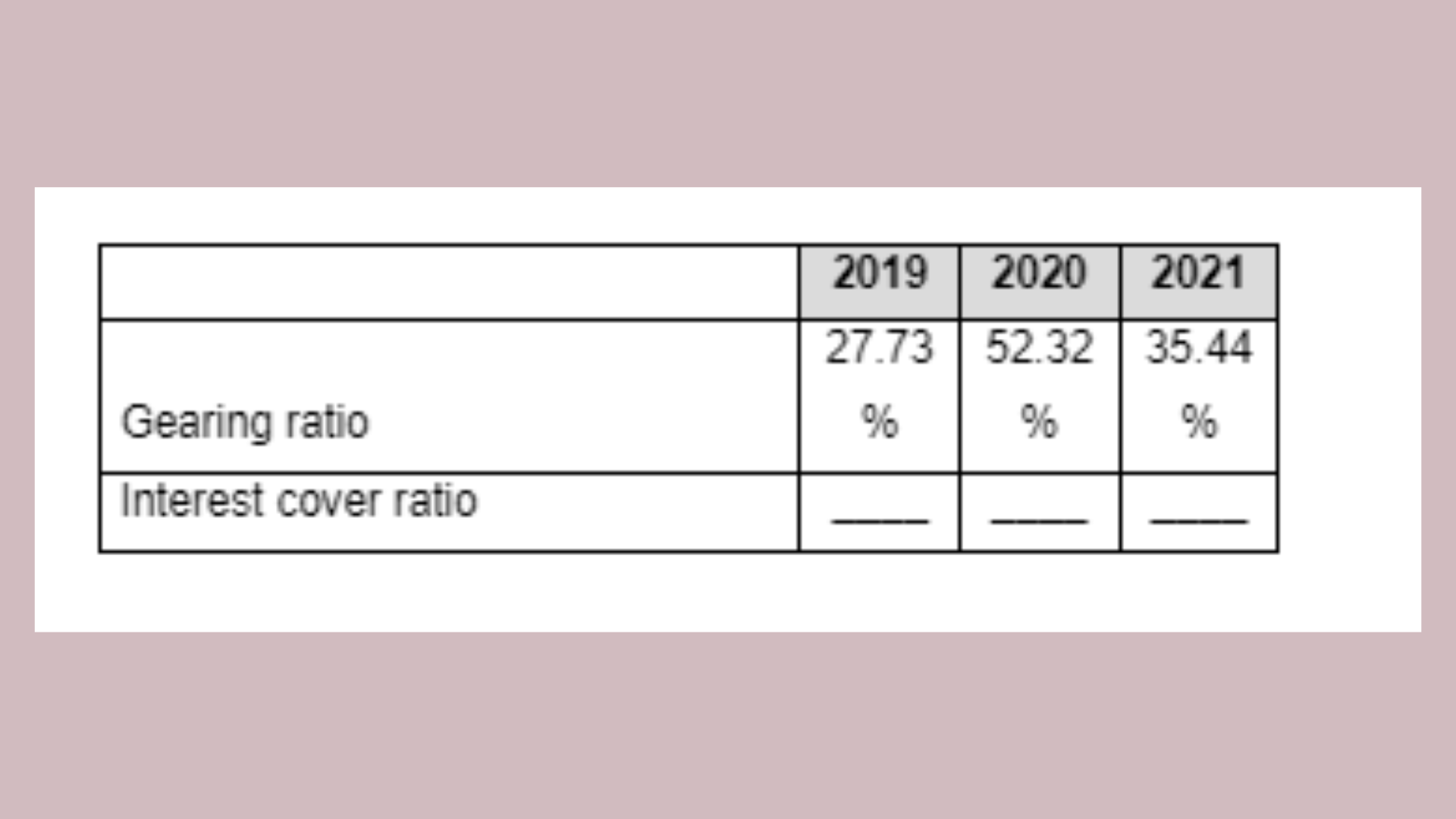

Financial Gearing

The relevant financial gearing ratios for 2019-2021 have been summarised in the table below.

The gearing ratio of the company deteriorated from 2019 to 2020 on account of the acquisition of MOCKA. However, the gearing ratio has significantly improved in 2021 which may be attributed to the increasing equity driven by record profitability by the company in 2021.

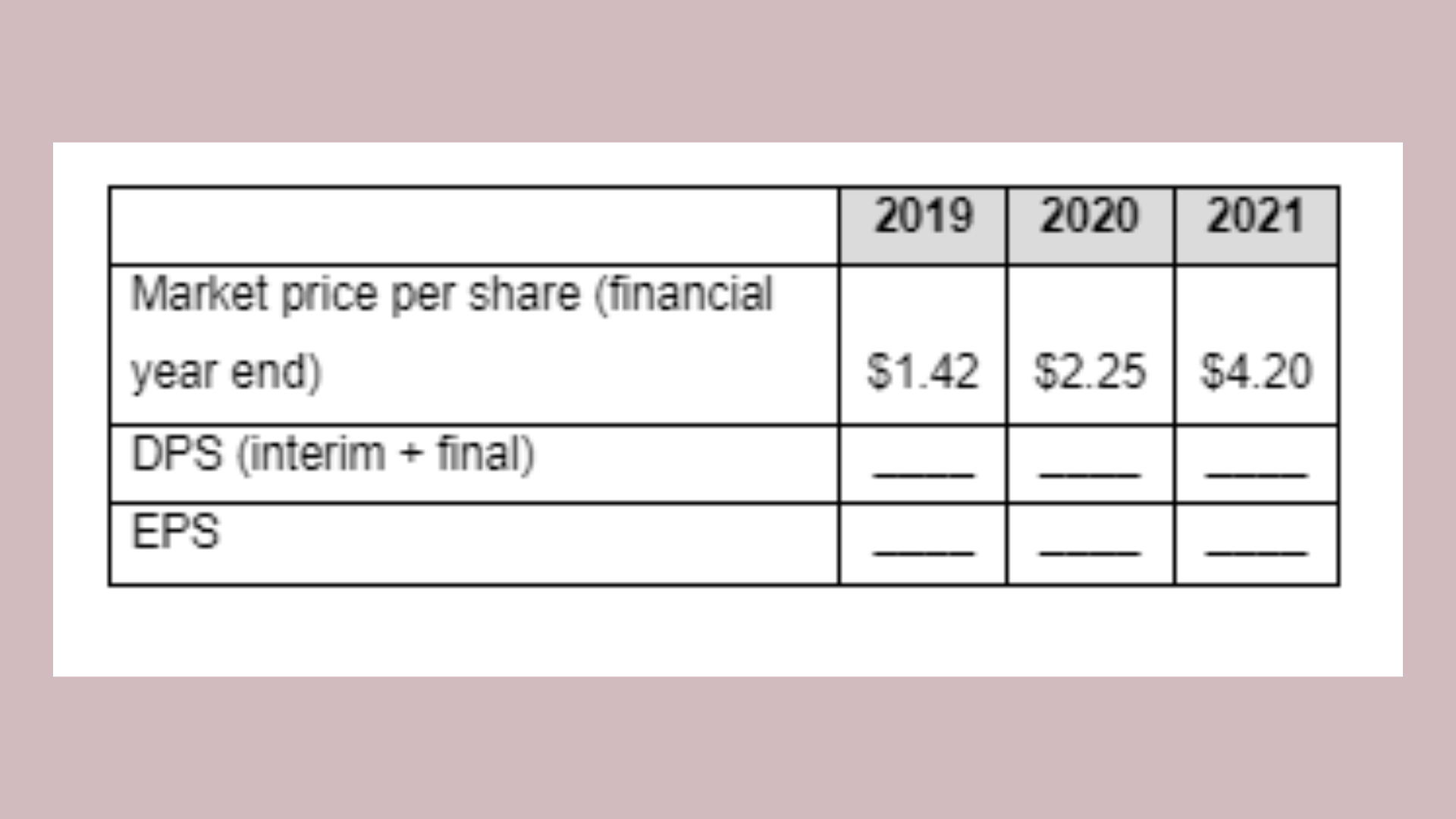

Investment Performance

The relevant investment performance ratios for 2019-2021 have been summarised in the table below.

The EPS of the company has shown significant improvement during the given period from 2019 to 2021 as it has more than doubled. This may be attributed to robust consumer demand, acquisition of MOCKA and increase in operating leverage driven by online sales. This has helped the company to avoid any adverse impact of pandemic and associated lockdowns.

This constitutes only 50% of the complete analysis. To know more, reach out to us through WhatsApp at +447956859420.

Part C– Evaluation of Financial Health

The last section of this solution provides a complete evaluation. Our experts have analyzed the financial review done above against the backdrop of the company’s overall background and proposed what this means for the company. We have provided a snippet of the complete evaluation below.

The discussion in part A and B clearly indicates that operating performance of the company has significantly improved during 2019-2021 aided by robust customer demand, multiple channels for sale, expanding profit margins and acquisition of MOCKA in 2020. The company has continued to invest in opening new stores in Australia & New Zealand along with setting up National Distribution Centre which should auger well for the future growth. The company has also focused on lowering gearing and leverage in 2021 which had increased on account of the MOCKA acquisition (Jackson, 2021). This paves way for future expansion and growth of the company as incremental capital can be raised at competitive rates.

Need help with your financial accounting assignment as well? Our experts are here to help you. Call us at +61871501720.