25624: Financial Metrics for Decision-Making Business Case Assignment Help

Question

25624: This assignment is taught under the course Bachelor of Business course for the University of Technology Sydney. In this assessment, the students are required to examine and analyze a case study provided for an organization Insurance Co., and use Microsoft Excel to perform the required calculations and write a detailed report answering the questions provided in the assessment file.

Solution

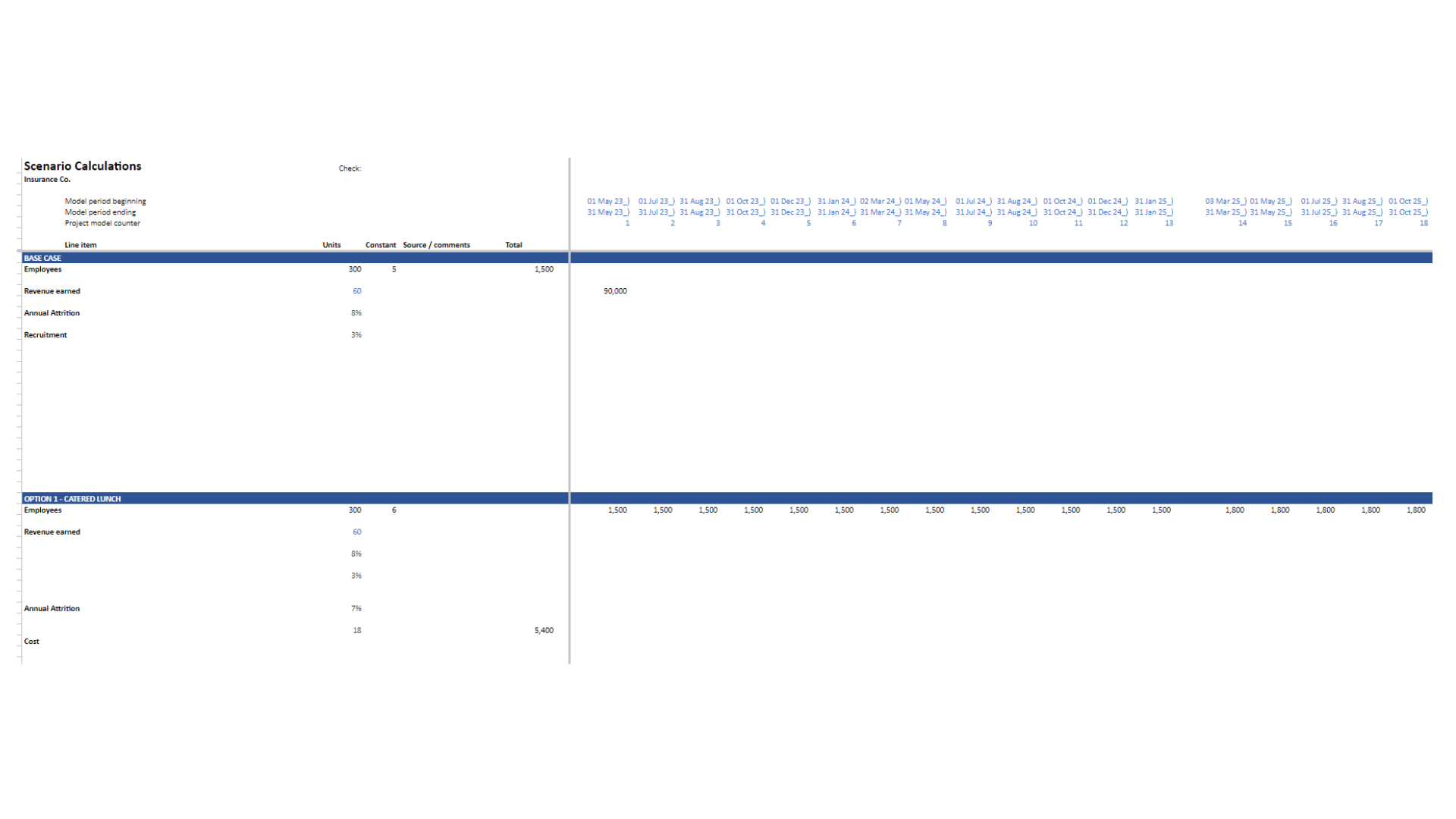

In providing help for this UTS business assignment, our experts have provided the two requirements of the assignment- the Written report and an Excel spreadsheet depicting the calculations that were completed by our experts for the ‘Scenario Calculations’ worksheet.

Excel Spreadsheet

Firstly, our experts have thoroughly analyzed the case study provided in the assessment file and the template provided to be used for presenting the data. Using this, our experts have created the ‘Scenario Calculations’ worksheet which depicts all the necessary calculations for the assignment.

If you are stuck with your calculations as well and need help with this University of Technology Sydney Assignment, reach out to us at onlineassignmentservices1@gmail.com.

Written Report

In this section, the two questions based on the case study have been answered, which is also supported by the data calculated in the first part of this assessment i.e. Excel spreadsheet.

Introduction

Our experts have helped in writing this report on the University of Technology Sydney Assignment by demonstrating proper knowledge of the financial metrics necessary for decision-making in businesses. This written report begins with a brief introduction to the case study.

The Insurance Firm’s sales crew has low productivity and a high turnover rate. The corporation is thinking about introducing new employee perk schemes in an effort to boost morale and output. Three employee-beneficial programs are now under consideration by the company.

We provide the best Business assignment help in Sydney. Don’t believe us? Check it out for yourself! Call us at +61 871501720.

Question 1

This section presents the answers for this 25624 Business Case Assignment. The first question demands the student to construct a base case scenario, which is depicted in the Excel worksheet by our experts. Using these calculations, the experts have elaborated on the impact of the various variables on the revenue of the organization, and how bringing modifications to the industry could serve as an important economical step.

In the baseline scenario, we anticipate no shifts in the company’s status quo. We will construct a scenario to illustrate the growth or decline of the workforce in terms of total income, effective hours worked, days worked, and direct revenue earned per employee, as well as the impact of new recruits and employee turnover. We will also demonstrate the difference between current revenue and what could be achieved if the company followed the typical rate of employee turnover in its sector.

Insurance Co.’s earnings are affected by the following factors:

- Workforce Size: Revenue potential increases in proportion to the size of the workforce.

- Attrition Rate: The potential income is proportional to the attrition rate; so, a lower attrition rate is preferable.

- Effective hours worked per day per employee: Daily average productive labor time: When productivity is great, businesses can earn more money from each worker. Increases in potential revenue are proportional to the ratio of direct revenue benefits per employee per effective hour worked.

Get Bachelor of Business assignment help at cheap prices. Reach out to us over WhatsApp at +447700174710.

Question 6

While providing help for this section of this UTS business assignment, our experts have presented all the important conclusions derived from the analysis of the case study and the calculations done in excel.

The primary conclusions drawn from this data analysis are as follows:

- There is a clear need to work on lowering the insurance firm’s attrition rate, which is much higher than the average for the sector.

- Cross-selling and upselling methods can be helpful in lowering attrition if they target consumers who have multiple policies with the insurance provider.

The insurance firm should prioritize initiatives to increase customer retention in light of these findings. Examples of this are:

- Increasing customer loyalty through upselling and cross-selling existing policyholders to buy more insurance from the company.

- Establishing trustworthy connections with clients through attentive, individual service and consistent updates on the status of their requests.

Here are some suggestions that the Insurance Company’s management might take into account in light of the results and analysis:

Conducting an employee engagement survey would provide valuable insight into the causes of the company’s high turnover rate. This would allow management to zero in on the most pressing problems and devise effective solutions.

Streamline the onboarding procedure because it sets the tone for the employee’s time with the organization. Management has the opportunity to examine the current orientation procedure and suggest changes. Some ways to achieve this goal include giving more in-depth training, pairing up mentors with new workers, and cultivating a positive and accepting work atmosphere.

Get quality assured 25624: Financial Metrics for Decision-Making Business Case Assignment Help by our highly skilled experts. Reach out to us at onlineassignmentservices1@gmail.com.